What are mortgage instructions? This fundamental question forms the gateway to understanding the intricate process of securing a home loan. These instructions serve as a comprehensive manual, housing a wealth of essential information about mortgages. They lay out the terms and conditions governing the mortgage agreement, outline the specific responsibilities held by both borrowers and lenders and meticulously map out the step-by-step process necessary to complete the mortgage application.

So, get ready to dive into the world of mortgage instructions, where understanding the fine print can be the key to unlocking the door to your dream home!

Table of Contents:

Importance of Understanding Mortgage Instructions

Mortgage instructions are not mere pieces of paper; they are the guiding stars that navigate you through the convoluted labyrinth of homeownership dreams. Understanding mortgage instructions ensures you make informed decisions, avoid pitfalls, and sail smoothly through the application process. This understanding empowers you to decipher intricate legal documents, assess your creditworthiness, and strategically plan for a successful home purchase.

Overview of the Mortgage Process

The journey begins with the crucial step of a mortgage application, where your employment history, financial situation, and other pertinent details come into play. Many opt for preapproval before diving into this process, which sets the stage for a streamlined experience. It’s worth noting that mortgage lenders assess various factors, including your creditworthiness, to determine your home-buying eligibility and applicable mortgage interest rates.

| Did you know? The average 5-year fixed insured mortgage rate is currently 5.97%, up 14 basis points from 30 days ago. |

Preparing for a Mortgage Application

As you set forth on the path to secure your dream home, the significance of preparation becomes abundantly clear. From the essential documentation to the profound importance of full transparency in your application each facet plays a pivotal role. Explore the concept of rate lock, a strategic shield against market fluctuations.

Necessary Documentation for Mortgage Application

When applying for a mortgage, having the right documentation is paramount. Lenders require comprehensive information to assess your eligibility. Here’s a breakdown of the necessary documentation:

- Employment History: A detailed work history record assures lenders of your stability and capacity to meet payment obligations.

- Creditworthiness: Your credit score and history give lenders insight into your financial responsibility and ability to manage debt.

- Financial Situation: A transparent overview of your financial situation, including income, assets, and debts, helps lenders determine your loan amount and terms.

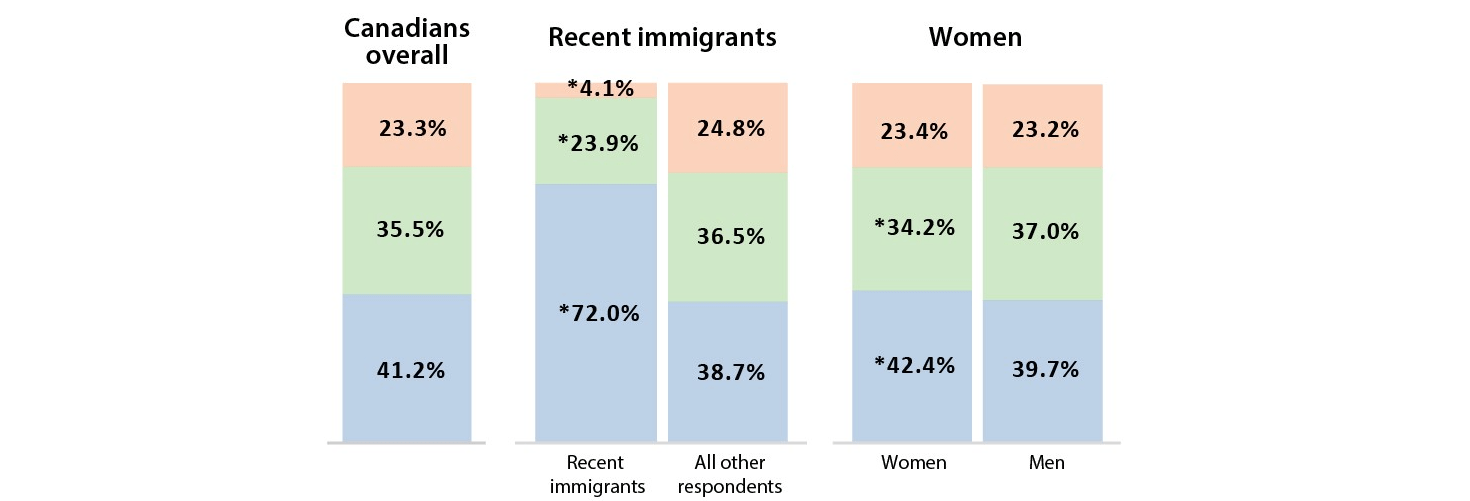

| Did you know? More than a third of Canadians have a mortgage (35.5%) This means there are around 12 million mortgages currently in play. |

Importance of Full Disclosure in Application

In mortgage applications, honesty is not just the best policy—it’s the only one. Full disclosure of your financial details and circumstances is imperative. Lenders use this information to assess risk and offer appropriate terms. Withholding or misrepresenting information can lead to complications and potentially jeopardize your application’s success.

The Concept of Rate Lock and its Importance

A rate lock is an agreement between you and the lender to freeze the interest rate for a specified period, usually until closing. This shields you from market fluctuations, ensuring that even if interest rates rise, your rate remains locked at the agreed-upon level. This can be especially beneficial when mortgage interest rates are expected to increase.

The Mortgage Process Explained

We embark on a voyage that unravels the complexities of acquiring your dream home. From decoding the nuances of budgeting and pre-approval to delving into the world of property exploration and lender selection, every aspect is illuminated.

Budgeting and Determining Affordability

Before plunging into the intricacies of mortgages, create a practical budget and understand what you can afford. This involves a comprehensive analysis of your financial standing, considering factors such as your income, expenditures, and existing debts. Firstly, evaluate your financial situation meticulously to accurately ascertain your borrowing capacity.

Secondly, calculate the potential monthly mortgage payments to ensure they align harmoniously with your established budget. Lastly, don’t overlook the significance of accounting for supplementary costs like property taxes, insurance, and maintenance expenses. By methodically considering these elements, you pave the way for a more informed and secure foray into the mortgage domain.

Getting Pre-approved for a Loan

Preapproval furnishes a lucid comprehension of your budgetary confines. Concurrently, it serves as a testament to sellers, showcasing your earnest intent as a committed buyer. Initially, the submission of essential documentation to a lender for meticulous evaluation; subsequently, the lender conducts a comprehensive assessment of your creditworthiness and overall financial state.

This process culminates in issuing a preapproval letter, denoting the extent to which you are eligible to borrow. This preliminary endorsement bolsters your standing and confidence as you embark on the journey toward homeownership.

Finding a Home and Making an Offer

Dedicate time to researching and personally exploring properties that match your budget constraints and individual preferences. Collaborating with a seasoned real estate agent is pivotal; their expertise will guide you through the negotiation process and aid in formulating an offer for a property that genuinely captivates you.

When crafting your offer, incorporate contingencies such as a meticulous home inspection and a comprehensive appraisal. This thorough approach ensures that your journey towards property ownership is marked by well-informed decisions, aligning with your aspirations and guaranteeing a comprehensive evaluation of your chosen property.

Choosing a Mortgage Lender

The process of choosing the optimal mortgage lender significantly shapes your home-buying journey. Factors to weigh include mortgage interest rates, necessitating comparing rates from various lenders to identify the most advantageous terms.

Additionally, assessing your home buying eligibility is essential; ensure that the lender provides loan options that align with your needs and financial circumstances. Lastly, don’t underestimate the importance of customer service.

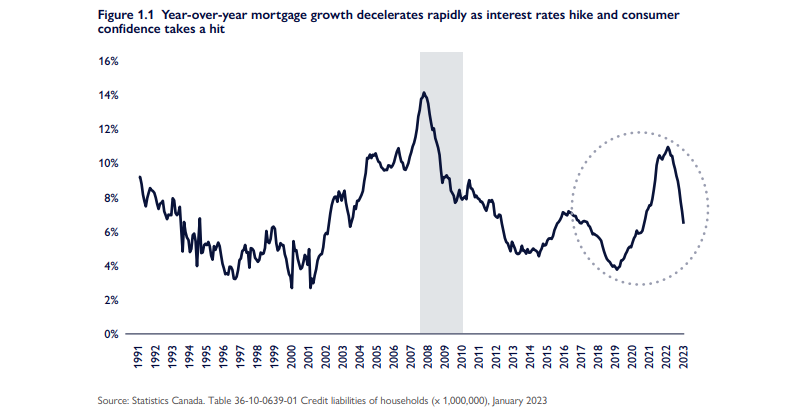

| Did you know? Canada’s total residential mortgage debt was $2.08 trillion as of January this year, up six per cent from January 2022. |

Legal Aspects of Mortgage Instructions

This section is your gateway to understanding the legal foundations crucial for your homeownership journey. We’ll explore the binding legal documents that define your mortgage terms and delve into the importance of adhering to their integrity.

Legal Documents Involved

The journey of securing a mortgage is accompanied by a series of legal documents that establish the terms and conditions of the loan agreement. These documents are legally binding and play a significant role in the mortgage process. Standard legal documents include:

- Loan Agreement: Outlines the terms, interest rate, repayment schedule, and other essential loan details.

- Promissory Note: A promise to repay the loan amount and the interest according to the agreed-upon terms.

- Mortgage Deed: Puts the property up as collateral for the loan and gives the lender the right to foreclose in case of default.

Restrictions on Altering Mortgage Documents

It’s crucial to understand that changing your mortgage documents comes with consequences. Some key restrictions involve making changes to preapproval terms. It could cancel your preapproval if you alter important financial details without your lender’s permission.

Similarly, unauthorized adjustments to the established rate lock agreement may lead to elevated interest rates, impacting your payment structure. Vigilance regarding these aspects is crucial in ensuring the integrity of your mortgage terms and safeguarding your financial stability.

Consequences of Unauthorized Alterations

Engaging in such alterations is classified as a breach of the contract and can yield the subsequent consequences. Lenders possess the prerogative to initiate legal proceedings to uphold the loan’s initial terms.

Unauthorized alterations could lead to escalated interest rates, resulting in a heightened financial burden throughout the loan’s duration. In the event of default stemming from unauthorized alterations, the ramifications can extend to your credit score, adversely influencing your creditworthiness and potential for future borrowing endeavors.

| Did you know? A new survey by the Real Estate and Mortgage Institute of Canada shows that over a third of Canadians regret their current mortgage situation. |

FAQ

What are mortgage instructions?

Guidelines from lenders outlining terms and conditions for property transactions.

Why are mortgage instructions important?

They clarify terms, conditions, and expectations for both lender and borrower.

Who typically prepares the mortgage instructions?

The lender or their legal team.

Can mortgage instructions be negotiated?

Main terms are negotiated beforehand; instructions are typically standard procedures.

What happens if there’s a discrepancy in the mortgage instructions?

Address immediately with the lender to avoid complications.

Do all mortgages come with mortgage instructions?

Yes, they detail the loan’s terms and conditions.

What should I do if I don’t understand something in the mortgage instructions?

Consult with a lawyer or mortgage professional.

What Are Mortgage Instructions – Final Words

Mortgage instructions serve as a pivotal guide in the intricate dance of property financing. They delineate the terms, conditions, and obligations both lenders and borrowers must adhere to. For any homebuyer or property investor, comprehending these instructions is crucial, as they lay the groundwork for the financial relationship moving forward. Misunderstandings or oversights can lead to complications, delays, or even legal repercussions.

As real estate transactions grow in complexity, the role of clear, concise mortgage instructions becomes even more paramount. Whether you’re a first-time homebuyer or a seasoned investor, always prioritize understanding every detail in these instructions. Seeking clarity and, if necessary, professional advice, can pave the way for a smoother, more informed mortgage experience.