The Canadian mortgage landscape is a dynamic and multifaceted realm that requires a comprehensive understanding of those navigating the process. One crucial aspect of this landscape is understanding the average mortgage (Canada).

This article will provide a concise overview of the Canadian mortgage landscape and underscore the significance of comprehending average mortgage rates.

Table of Contents:

Average Mortgage Rates in Canada

When obtaining a mortgage in Canada, borrowers are confronted with choices, particularly between fixed and variable mortgage rates. Fixed rates remain steady throughout the mortgage term, offering stability and predictability in monthly payments. Conversely, variable rates fluctuate in response to changes in the Bank of Canada interest rates, resulting in varying monthly payments.

In case you’re not closely familiar with mortgages, then it is worth reading our mortgage instructions article where we familiarize you with the term and.

Mortgage loan insurance is required for homebuyers who provide a down payment of less than 20% of the purchase price to safeguard lenders against potential defaults. This insurance is facilitated by organizations like the Canada Mortgage and Housing Corporation (CMHC) and serves to mitigate risk for lenders, enabling them to offer mortgages to a broader range of borrowers.

The Importance of Understanding Average Mortgage Rates

Being well-informed about average mortgage rates in Canada holds significant advantages:

- Financial Planning: Knowledge of current mortgage rates empowers borrowers to plan their finances accurately and anticipate future expenses. Understanding the potential impact of interest rate fluctuations enables homeowners to adjust their financial strategies accordingly.

- Mortgage Affordability: Average mortgage rates directly influence the affordability of homeownership. Interest rate changes can substantially impact monthly payments, potentially affecting an individual’s ability to afford their mortgage.

- Mortgage Rate Comparison: Staying informed about average mortgage rates facilitates effective comparison shopping among different mortgage lenders in Canada. This empowers borrowers to make informed decisions and select the most favourable terms and conditions for their mortgages.

| Did you know? As of July 24, 2023, Citadel Mortgages offers the best 1-year fixed insured mortgage rate at 6.29%. |

Understanding Mortgage Rates in Canada

Let’s delve deeper into the concept of mortgage rates and how they function within the Canadian context. Understanding the intricacies of mortgage rates is crucial for borrowers seeking favourable terms and conditions. Let’s explore the factors that influence mortgage rates in Canada and discuss the impact of the Bank of Canada’s interest rates on these rates.

Explanation of Mortgage Rates

Mortgage rates refer to the interest rates lenders charge on the money borrowed to finance a home purchase. These rates determine the cost of borrowing and are a significant factor in the overall affordability of homeownership. Mortgage rates can be classified into two main categories: fixed mortgage rates and variable mortgage rates.

Fixed mortgage rates remain constant throughout the mortgage term. This offers stability and predictability, as borrowers can accurately plan their finances based on fixed monthly payments.

Variable mortgage rates fluctuate in response to the Bank of Canada’s interest rate changes. When the central bank adjusts its rates, variable mortgage rates may increase or decrease, resulting in varying monthly payments for borrowers.

Factors Influencing Mortgage Rates in Canada

Several factors influence mortgage rates in Canada. Lenders consider these factors when determining the interest rates they offer to borrowers. Some key factors include:

- Bank of Canada’s Interest Rates: The Bank of Canada’s interest rates serve as a benchmark for mortgage rates in Canada. When the central bank adjusts its rates, it can directly impact the interest rates offered by lenders.

- Economic Conditions: The overall state of the economy, including factors such as inflation, employment rates, and economic growth, can influence mortgage rates. During economic stability and growth periods, mortgage rates may be more favourable.

- Government Policies: Government policies, such as regulations on lending and monetary policy measures, can impact mortgage rates. Changes in regulations or government initiatives may affect lenders’ risk assessment and, in turn, influence interest rates.

- Mortgage Market Competition: The level of competition among mortgage lenders in Canada can also impact mortgage rates. Increased competition may lead to more competitive rates as lenders strive to attract borrowers.

Impact of the Bank of Canada’s Interest Rates

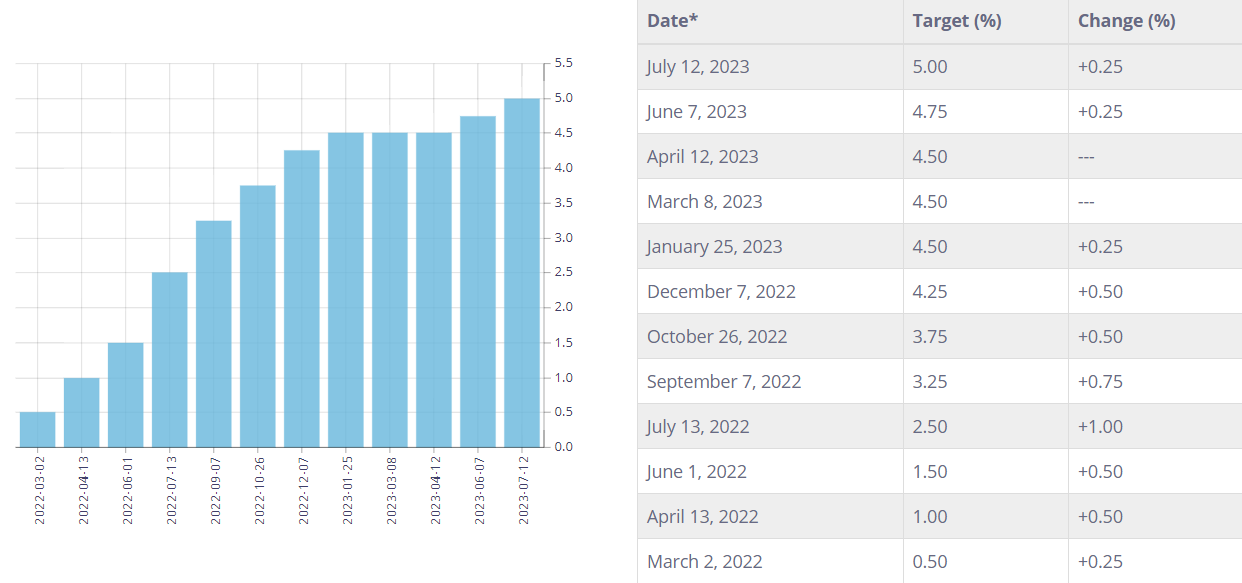

The Bank of Canada’s interest rates play a significant role in determining mortgage rates across the country. As the central bank adjusts its rates, it influences the cost of borrowing for financial institutions. This, in turn, affects the rates offered to borrowers. When the Bank of Canada raises its rates, mortgage rates may increase, potentially resulting in higher monthly payments for homeowners. Conversely, when the central bank lowers its rates, mortgage rates may decrease, offering potential savings for borrowers.

Monitoring the Bank of Canada’s interest rates is essential for individuals seeking to stay informed about potential changes in mortgage rates. Understanding how these rates impact borrowing costs can help borrowers make informed decisions and exploit favourable market conditions.

| Did you know? The Bank of Canada decided to increase its target for the overnight rate to 5% on July 12, with the Bank Rate at 5¼% and the deposit rate at 5%. |

The Current State of Mortgage Rates in Canada

As one of the cornerstones of the country’s economy, fluctuations in mortgage rates can have far-reaching effects on the real estate landscape and the overall financial well-being of Canadian households. The state of mortgage rates in Canada is a subject of significant importance, as it plays a pivotal role in shaping the accessibility of homeownership and the dynamics of the housing market.

Current Average Mortgage Rates in Canada

Mortgage rates can vary depending on several factors, including the type of mortgage, the borrower’s creditworthiness, and market conditions. As of the most recent data available by RBC Royal Bank, the average mortgage rates in Canada are as follows:

| Term | Special offers | APR(The annual percentage rate) |

| 2 Year Fixed | 6.740% | 6.800% |

| 5 Year Fixed | 6.290% | 6.320% |

| 5 Year Variable | RBC Prime Rate – 1.150% (7.050%) | 7.080% |

It is important to note that these rates are subject to change and can vary among different lenders. Borrowers are advised to consult with mortgage lenders directly or use online resources to obtain the most up-to-date information on mortgage rates.

Comparison of Mortgage Rates among Canadian Provinces

Mortgage rates can also vary among different Canadian provinces. Factors such as local economic conditions and housing market dynamics can influence the rates offered in each province. You can use our free Mortgage Rate Comparison tool. Here is a comparison of average mortgage rates across selected Canadian provinces:

| Province | Fixed Mortgage Rates (5-year term) | Variable Mortgage Rates (Prime Rate + x%) |

| Ontario | 3.10% – 3.80% | Prime Rate + 2.00% – 2.70% |

| British Columbia | 3.20% – 3.90% | Prime Rate + 2.10% – 2.80% |

| Quebec | 2.90% – 3.70% | Prime Rate + 1.90% – 2.60% |

| Alberta | 3.00% – 3.80% | Prime Rate + 2.00% – 2.70% |

Notably, these rates are provided for illustrative purposes and may not reflect the current rates accurately. Borrowers should consult with local mortgage lenders or utilize online resources for precise and up-to-date mortgage rate information specific to their province.

You can also opt to use our Mortgage Calculator to get the information you need.

Analysis of Trends in Canadian Mortgage Rates: 3 Trends

Over the past few years, Canadian mortgage rates have experienced fluctuations influenced by various factors, including changes in the Bank of Canada’s interest rates and market conditions. Here are some notable trends in Canadian mortgage rates:

- Historic Lows: In response to economic conditions, the Bank of Canada reduced its key interest rates, resulting in historically low mortgage rates over the past several years. This created favourable borrowing conditions for homeowners and buyers.

- Gradual Increases: As the economy recovers and inflationary pressures emerge, the Bank of Canada gradually increases its interest rates. This has resulted in a gradual rise in mortgage rates, although they remain relatively low compared to historical averages.

- Regional Variations: Mortgage rates can vary across different regions of Canada. Provinces with stronger economies and high housing demand may experience slightly higher mortgage rates compared to provinces with more subdued housing markets.

| Did you know? The highest variable mortgage rate was 22.75% in August 1981, when Canada’s prime rate reached a record high. |

Implications and Considerations for Borrowers

When obtaining a mortgage, borrowers face specific implications and considerations unique to this type of loan. A mortgage is a significant financial commitment, usually spanning several years, and it involves buying or refinancing a property.

Impact of Average Mortgage Rates on Home Buyers and Homeowners

The average mortgage rates in Canada directly impact both home buyers and homeowners in several ways. Firstly, mortgage rates significantly influence the affordability of homeownership. Higher rates can increase monthly mortgage payments, potentially limiting home buyers’ purchasing power.

Furthermore, mortgage rates determine the cost of borrowing for homeowners. Lower rates result in lower interest expenses over the life of the mortgage, while higher rates can lead to increased interest costs.

Mortgage rates also affect the feasibility of refinancing existing mortgages. Lower rates may allow homeowners to refinance their mortgages and potentially reduce their monthly payments or access equity.

Strategies for Navigating Mortgage Rates

When considering mortgage rates, borrowers can employ several strategies to make informed decisions:

- Fixed vs. Variable Rates: Borrowers have to consider the advantages and disadvantages of fixed and variable mortgage rates. Fixed rates provide stability and predictability, while variable rates offer the potential for savings if the Bank of Canada’s interest rates remain low.

- Rate Comparison: Conducting a thorough mortgage rate comparison is crucial to finding the most favourable terms and conditions. Online resources and mortgage brokers can assist borrowers in comparing rates from various lenders.

Mortgage Loan Insurance for Down Payments Less than 20%

Mortgage loan insurance is generally required for borrowers making down payments of less than 20% of the home’s purchase price. This insurance protects the mortgage lender in the event of default and enables borrowers to access competitive interest rates.

Home Buying Programs, Plans, and Incentives for First-Time Home Buyers

First-time home buyers in Canada can benefit from various programs, plans, and incentives, including:

- The Home Buyers’ Plan (HBP) allows first-time buyers to access up to $35,000 from their Registered Retirement Savings Plan (RRSP) tax-free for a down payment.

- The First-Time Home Buyer Incentive offers shared equity mortgages, where the government provides a portion of the down payment in exchange for shared ownership of the property.

FAQ

What is the average mortgage rate in Canada?

Average mortgage rates in Canada can fluctuate depending on factors such as the type of mortgage and market conditions. Borrowers should consult with lenders or utilize online resources for the most up-to-date rates.

How are mortgage rates determined?

Mortgage rates are influenced by factors such as the Bank of Canada’s interest rates, economic conditions, and competition among lenders.

What is the difference between fixed and variable mortgage rates?

Fixed mortgage rates remain constant throughout the mortgage term, while variable rates can fluctuate based on changes in the Bank of Canada’s interest rates.

How does the Bank of Canada’s interest rate affect mortgage rates?

Changes in the Bank of Canada’s interest rates can impact mortgage rates offered by lenders. When the central bank adjusts its rates, mortgage rates may increase or decrease accordingly.

Average Mortgage Canada – Final Words

Understanding the implications of average mortgage rates in Canada is crucial for borrowers. Individuals can make informed decisions when navigating the mortgage landscape by staying informed, considering different rate options, and exploring available programs and incentives. Regularly monitoring mortgage rates and consulting with mortgage professionals can help borrowers secure the most favourable terms and achieve their homeownership goals.