For those entering the realm of commercial leasing for the first time, the intricate and detailed nature of the contracts can be quite astonishing. Unlike residential agreements, leases for commercial spaces possess distinct characteristics, particularly due to landlords potentially stipulating an additional payment alongside the actual rent.

What is TMI in real estate? This supplementary payment typically encompasses taxes, maintenance, and insurance, often referred to as TMI. Discovering this financial obligation could substantially impact the affordability of the space.

Table of Contents:

Components of TMI

Total Monthly Investment (TMI) is an important concept in real estate that encompasses the various costs associated with owning a property. These costs include property taxes, maintenance expenses, and insurance premiums. Property taxes are financial contributions to local governments, determined based on the property’s assessed value and prevailing tax rates. Maintenance costs encompass the expenses incurred to ensure a property’s optimal condition, with options like the “1% rule” and “square footage rule” for budgeting.

Insurance serves as a protective layer, with home insurance costs varying by region and policy specifics. The calculation of TMI enables tenants and landlords to evaluate the total financial commitment associated with the property. Understanding TMI is essential for evaluating the total financial commitment associated with a property.

Taxes

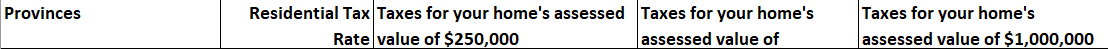

Property taxes, a pivotal segment of TMI, entail financial contributions to local governments. These contributions are determined based on the property’s assessed value and prevailing tax rates. They are taxes levied on the owners of real estate properties, such as land, buildings, and other structures. The amount of property tax you owe is usually determined based on the assessed value of your property.

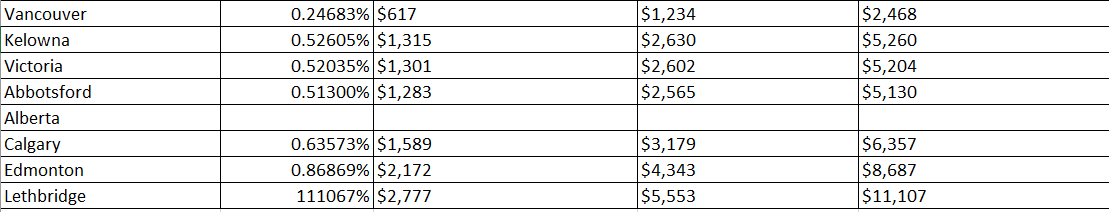

British Columbia

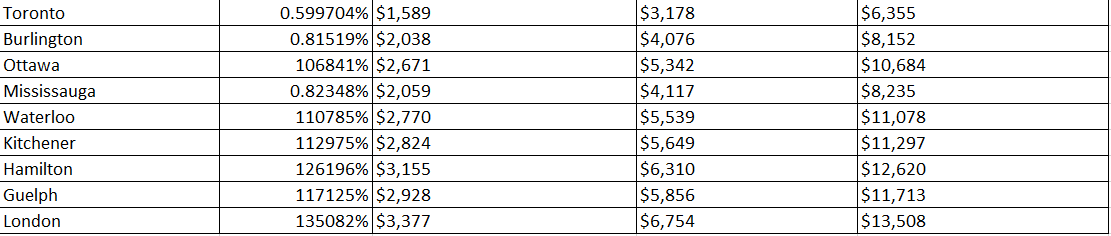

Ontario

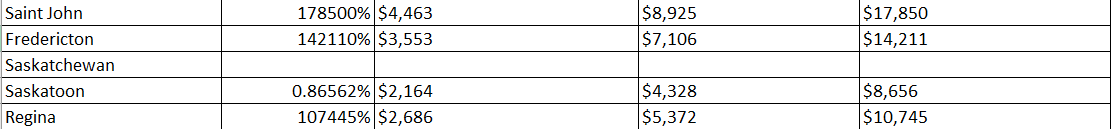

New Brunswick

Quebec

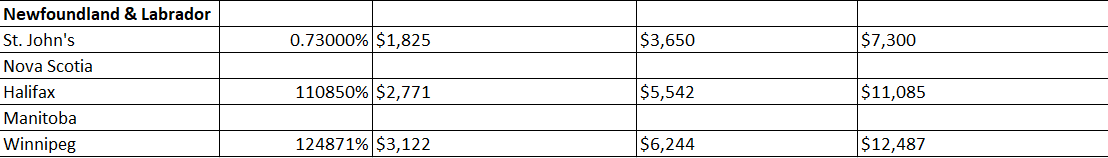

Newfoundland & Labrador

Vancouver boasts the lowest property tax rate in Canada, but it also has some of the most expensive homes, averaging above $1 million. In general, cities such as Vancouver and Toronto have high home values and low property taxes, while cities with low home values have some of the highest tax rates.

| Did you know? Property taxes are used to fund essential services and infrastructure in Canadian communities, such as roads, parks, public transit, emergency services, social programs, and education. |

Maintenance

Maintenance costs, another integral piece of TMI, encompass the expenses incurred to ensure a property’s optimal condition. From routine repairs to significant upkeep, these costs factor significantly into TMI.

The “1% rule” suggests that homeowners should allocate 1% of their property’s purchase price yearly for maintenance expenses. To illustrate, if you bought a home for $500,000, you would budget $5,000 annually for upkeep. However, some experts consider this allocation conservative and propose setting aside as much as 3% to 5% instead. Maintaining a $500,000 home in proper condition could require an annual budget ranging from $15,000 to $25,000.

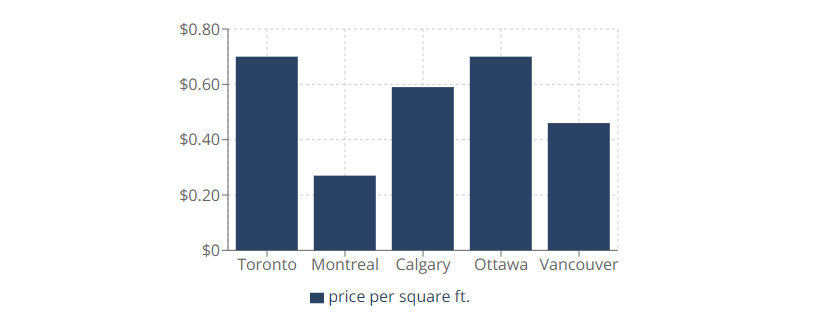

An alternative approach suggests using the “square footage rule,” where homeowners set aside $1 per square foot of their property’s size for maintenance and repairs. While this strategy acknowledges that larger homes might require more maintenance, it overlooks various factors impacting costs. For instance, newer homes won’t require immediate appliance replacements regardless of their size. Moreover, the expenses are influenced by location, including labor costs, a significant component for non-Do-It-Yourself repairs.

If you are living in a condo in Toronto, monthly fees vary widely and often increase as the building ages. They range from around $0.60 to $0.75 per square foot, so for a 600-square-foot unit, you can expect to pay $360 to $450 per month. Larger units will have higher fees, with 1,000 square feet costing $600 to $750 or more per month.

| Did you know? Between two similar buildings, the one with more units may have lower fees. However, more units can result in greater wear and tear, potentially costing more to maintain over time. |

Insurance

Real estate insurance forms the safety net within TMI, guarding against unforeseen events that may impact the property’s value. The costs associated with insurance serve as a layer of protection for landlords and tenants alike.

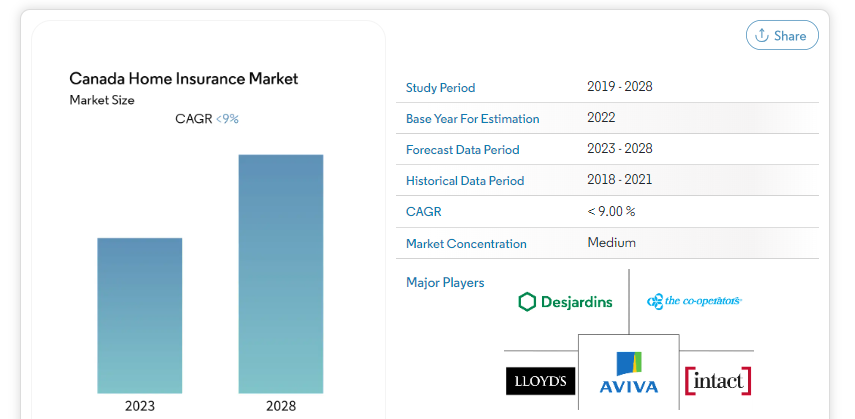

In Canada, the annual cost for home insurance averages around $1,100 in 2023. Nevertheless, the diversity in policyholders leads to substantial variations in home insurance costs due to numerous influencing elements. One pivotal aspect is your geographical location; different provinces have differing average rates.

For instance, Ontario and British Columbia generally exhibit notably higher rates compared to the Maritime provinces. Additionally, your chosen policy and coverage specifics also influence home insurance rates.

How TMI is Calculated

The calculation of TMI is akin to assembling the pieces of a puzzle. This summation enables tenants and landlords to evaluate the total financial commitment associated with the property.

Example for 3,000 square feet of office space: $12.00 base rent + $8.00 T.M.I.

$12.00 Net + $8.00 TMI = $20.00 (Gross) x 3,000 sq.ft. = $60,000.00 annually

or monthly payments of = $4,350.00 + 13% HST.

The Significance of TMI in Real Estate

Total Monthly Investment (TMI) is a crucial concept in real estate that encompasses the various expenses that come with owning or renting a property, including property taxes, maintenance expenses, and insurance premiums. TMI enables sellers to price properties strategically and helps buyers assess affordability.

Its dynamic nature, influenced by changing factors such as property tax assessments, insurance rates, and maintenance costs, underscores the need for vigilance. TMI also plays a pivotal role in commercial lease negotiations, with strategies available for both buyers and sellers. Negotiating TMI can be challenging due to variable costs, the need to balance property maintenance with cost minimization, and shifting real estate market trends.

However, with clear lease terms, transparency, and contingencies for handling TMI fluctuations, both landlords and tenants can navigate TMI negotiations successfully.

How TMI Affects Property Pricing

The amalgamation of property taxes, maintenance costs, and insurance expenses within the TMI construct a realistic portrayal of the property’s financial burdens. This, in turn, enables sellers to price their properties competitively, considering both the tangible assets and the intangible responsibilities associated with the property. Additionally, buyers armed with TMI insights can make more accurate assessments of their affordability, making the negotiation process smoother and more efficient.

Can TMI Fluctuate Over Time?

TMI is not carved in stone; it possesses the capacity to undergo fluctuations. Factors such as changing property tax assessments, varying insurance rates, and evolving maintenance costs can all contribute to shifts in the TMI landscape. Staying vigilant and well-informed about these potential fluctuations is vital for landlords and tenants.

How to Negotiate TMI in a Lease

Negotiating TMI becomes a pivotal aspect when engaging in a commercial lease agreement. Tenants seeking favourable terms should consider the following strategies:

- Clear Lease Terms: Ensuring that lease terms explicitly outline the responsibilities of both parties concerning TMI can avert future disputes.

- Transparency: Requesting transparency in the breakdown of TMI components—property taxes, maintenance, and insurance—can pave the way for fair negotiations.

- Contingencies: Including provisions for handling TMI fluctuations due to unforeseen circumstances can mitigate potential financial strain.

For landlords, demonstrating flexibility and negotiation openness fosters goodwill and strengthens tenant relationships.

Challenges in Negotiating TMI

Navigating TMI negotiations is not without its challenges. Both parties must contend with intricate dynamics that encompass various aspects, including:

- Variable Costs: The unpredictability of property tax assessments, maintenance needs, and insurance rates introduces an element of uncertainty into negotiations.

- Balancing Act: Striking a balance between maintaining the property’s condition and minimizing costs is a delicate endeavour influencing TMI calculations.

- Market Trends: Shifting real estate market trends can impact property values, indirectly affecting TMI components like property taxes.

FAQ

What does TMI mean in Real Estate?

TMI in real estate stands for Taxes, Maintenance, and Insurance. It refers to the additional costs tenants pay in a commercial lease, beyond the base rent.

What is included in TMI Ontario?

In Ontario, TMI includes property taxes, maintenance fees, insurance premiums, and may encompass utilities, property management fees, and common area maintenance costs.

How is TMI calculated in a commercial lease?

TMI is calculated by adding the annual costs of property taxes, insurance, and maintenance, dividing this sum by the total square footage of the building, and then multiplying by the tenant’s square footage.

Can TMI fluctuate over time?

Yes, TMI can fluctuate due to changes in property taxes, insurance premiums, and maintenance costs, which may vary annually.

How to insure your business against rising TMI costs?

To protect against rising TMI costs, negotiate a lease with a fixed TMI rate, ensuring these costs remain constant throughout the lease term.

What does TMI mean in Construction?

In construction, TMI stands for Trade, Material, and Equipment, referring to the costs associated with materials, equipment, and labor needed for a construction project.

What are the hidden costs of triple net leases?

Hidden costs of triple net leases may include significant maintenance expenses, fluctuating property taxes, and insurance premiums that tenants are responsible for, in addition to base rent.

What is TMI in Real Estate – Final Words

In the realm of real estate, understanding industry-specific terms is crucial for both professionals and clients. TMI, or “Taxes, Maintenance, and Insurance,” is one such term that often surfaces in property rental contexts. It refers to the additional costs tenants might bear over and above their base rent. While the initial lease rate may seem manageable, it’s essential to factor in TMI to gauge the true financial commitment.

Whether you’re a business owner looking for a commercial space or an individual seeking residential property, being aware of TMI ensures there are no surprises down the line. As with all real estate endeavors, transparency, knowledge, and clear communication are key to navigating financial responsibilities and securing favorable terms for all parties involved.