The real estate Canada market – It is a vibrant and dynamic industry that is crucial to the country’s economy. Whether you want to buy, sell, or rent a property in Canada, or to find homes for sale under $50,000 in Canada – understanding the intricacies of the real estate market is essential. In this article, we will provide an overview of the Canadian real estate market, discuss its importance in the economy, and explore the diversity it offers.

Table of Contents:

Overview of the Canadian Real Estate Market

The Canadian real estate market encompasses many residential and commercial properties. It is known for its stability and steady growth over the years. Real estate agents in Canada play a vital role in assisting buyers and sellers throughout the property transaction process. They provide guidance and market expertise and ensure a smooth experience for both parties.

Importance of Real Estate in Canada’s Economy

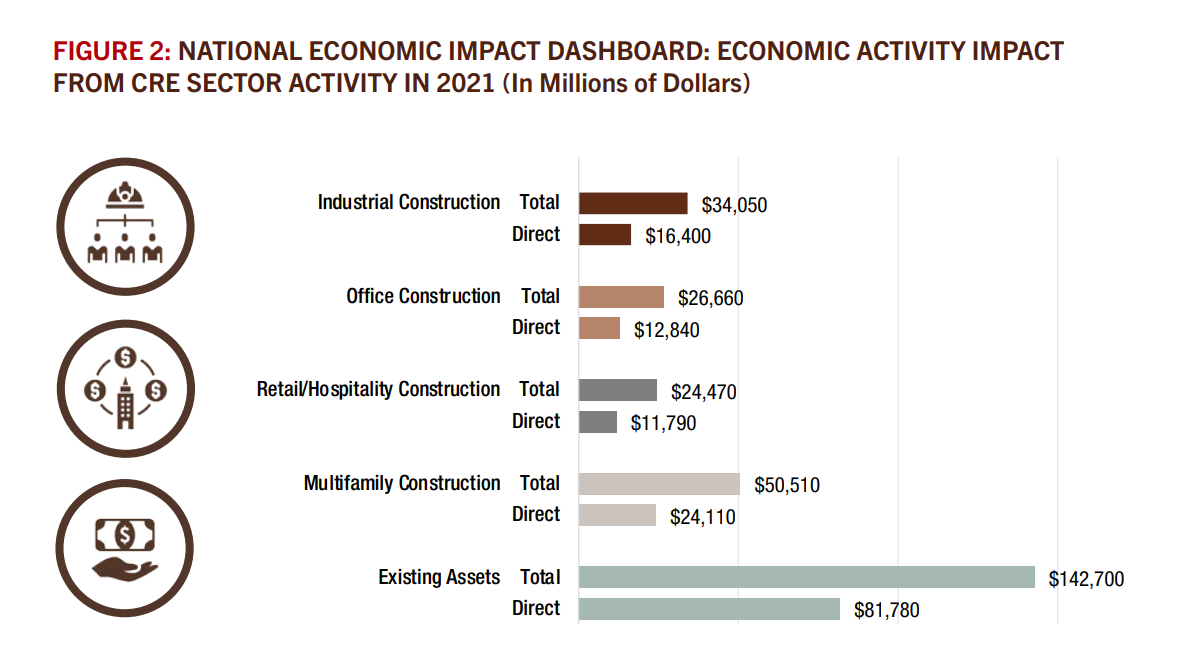

Real estate contributes significantly to Canada’s economy, generating jobs and income. It serves as a barometer of economic health and often reflects broader trends and indicators. The real estate industry creates employment opportunities in construction, property management, and related services. For example, in Canada in 2021, spending on building construction and ongoing operations in the commercial real estate sector added up to $278.4 billion in economic activity.

Additionally, it drives economic activity through associated sectors such as banking, insurance, and home improvement.

The Diversity of the Canadian Real Estate Market

One of the notable aspects of the Canadian real estate market is its diversity. It offers a wide range of options, including residential and commercial properties. Residential real estate caters to individuals and families seeking homes or apartments for personal use. Commercial real estate encompasses office buildings, retail spaces, industrial facilities, and more.

Real Estate Investment in Canada

Investing in Canadian real estate can be a lucrative venture. With careful research and an understanding of market trends, investors can make informed decisions and generate a steady income stream through rental properties or capital appreciation. Various financing options, including mortgages, support real estate investments in Canada.

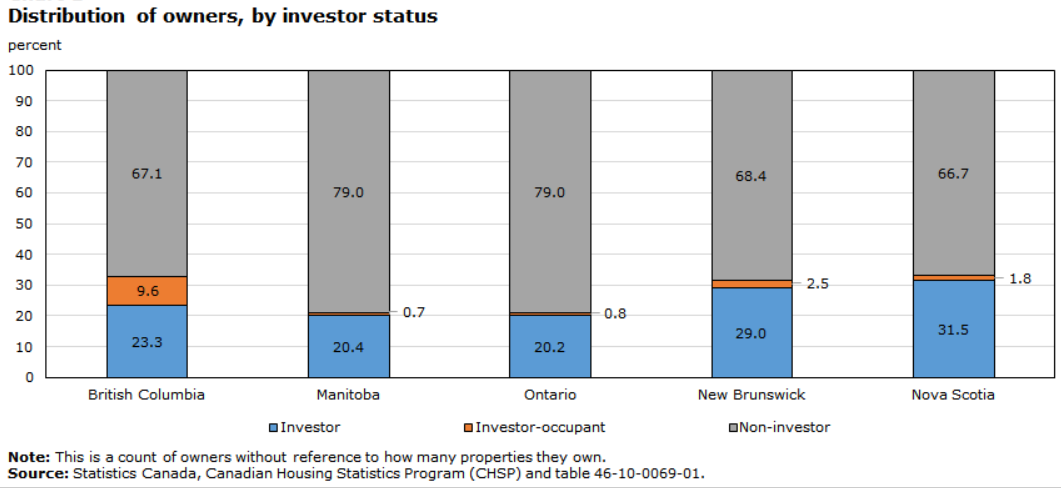

| Did you know? In 2020, the percentage of investors among owners ranged from 20.2% in Ontario to 31.5% in Nova Scotia. |

Understanding the Real Estate Market in Canada

In the previous article, we introduced the Canadian real estate market. Now, let’s delve deeper into key aspects of the market, including the role of realtors, buying, renting, and selling property, the impact of location on real estate prices, and the influence of economic factors.

The Role of Real estate agents in Canada

Real estate agents in Canada play a crucial role in facilitating real estate transactions. They are licensed professionals who assist buyers and sellers throughout the process. Realtors have in-depth knowledge of the local market, property valuation, and legal procedures. Their expertise helps buyers find suitable properties, negotiate deals, and navigate the complexities of buying or selling real estate.

Buying, Renting, and Selling Real Estate in Canada

Whether you’re interested in buying, rent, or selling property in Canada, it’s important to understand the process and legal considerations involved:

Buying property in Canada

- Conduct thorough research on the market and property listings to find the right property.

- Secure financing through mortgage options available in Canada.

- Hire the services of a realtor to guide you through property viewings, negotiations, and legal procedures.

- Complete due diligence, including property inspections and title searches, ensures smooth transactions.

- Close the deal by signing the necessary documents and transferring funds.

Renting property in Canada

- Search for rental properties through online listings, real estate agents, or property management companies.

- Understand the rental market and factors such as lease agreements, rent prices, and tenant rights.

- Complete rental applications, provide references, and go through a screening process.

- Sign the lease agreement, pay the required deposits and fees, and move into the rental property.

| Did you know? The Toronto Regional Real Estate Board MLS® System reported 10,525 condominium apartment rentals in Q1 2023, up four percent from Q1 2022. |

Selling property in Canada

- Determine the market value of your property through a real estate agent’s guidance or professional appraisal.

- List your home for sale through an agent or use online platforms.

- Market your property effectively, showcasing its features and attracting potential buyers.

- Negotiate offers, review contracts, and complete necessary legal paperwork.

- Close the sale by transferring the title and receiving payment.

The Impact of Location on Real Estate Prices in Canada

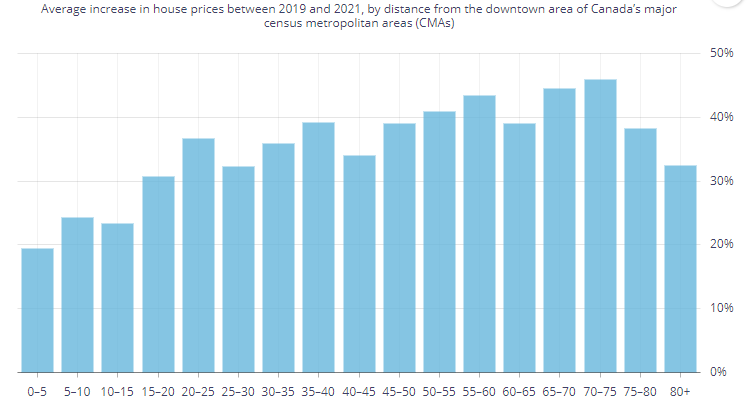

In the Canadian real estate market, location is a crucial factor that influences property prices. Desirable neighbourhoods with proximity to amenities, schools, transportation, and employment opportunities tend to have higher real estate prices. Urban centers and regions experiencing economic growth often see increased demand, resulting in price appreciation.

| Did you know? In Toronto and the municipalities bordering Toronto, the demand for single-family and other ground-related homes has outpaced the supply, driving up prices for these homes. |

The Influence of Economic Factors on the Real Estate Market

Canada’s real estate market is subject to various economic factors’ influence. These factors play a significant role in shaping the market dynamics and can profoundly impact buyers, sellers, and investors. Here are some key economic factors that influence the Canadian real estate market:

Changes in interest rates have a direct effect on mortgage rates. When interest rates rise, borrowing costs increase, making real estate less affordable for potential buyers. Conversely, when interest rates decrease, it can stimulate demand and make real estate more accessible.

The state of the economy, employment rates, and income levels are crucial factors in determining individuals’ ability to purchase and invest in real estate. Economic growth and job opportunities provide the financial stability necessary for buyers to enter the market and sustain their investments.

The balance between available properties’ supply and potential buyers’ demand heavily influences the real estate market. Property prices tend to rise in regions where demand exceeds supply, creating a seller’s market. Conversely, an oversupply of properties can lead to a buyer’s market and put downward pressure on prices.

Government regulations and policies have a significant impact on the real estate market. Measures related to taxation, zoning regulations, and housing affordability can shape market conditions and influence buyer behaviour. Changes in policies, such as introducing new taxes or incentives, can immediately affect real estate activity.

Understanding these economic factors is crucial for anyone in the Canadian real estate market.

Exploring Different Types of Real Estate in Canada

The Canadian real estate market offers various properties, catering to various preferences and investment strategies. In this article, we will explore different types of real estate in Canada, including residential properties such as houses, condos, and apartments, commercial properties like office spaces, retail units, industrial properties, and new developments and investment properties.

Residential Real Estate: Houses, Condos, and Apartments

Residential real estate in Canada encompasses properties intended for personal use. Here are some common types of residential properties:

- Houses: Houses are standalone structures typically offering more space and privacy. They come in various styles, sizes, and locations, allowing homeowners to customize and enjoy the benefits of homeownership.

- Condos: Condos, short for condominiums, are individual units within a larger building or complex. They offer amenities such as shared facilities, security, and maintenance services. Condos are popular for those seeking a more convenient and communal living experience.

- Apartments: Apartments are rental units within multi-unit buildings. They provide flexibility and affordability for tenants who prefer not to commit to homeownership or prefer the convenience of renting.

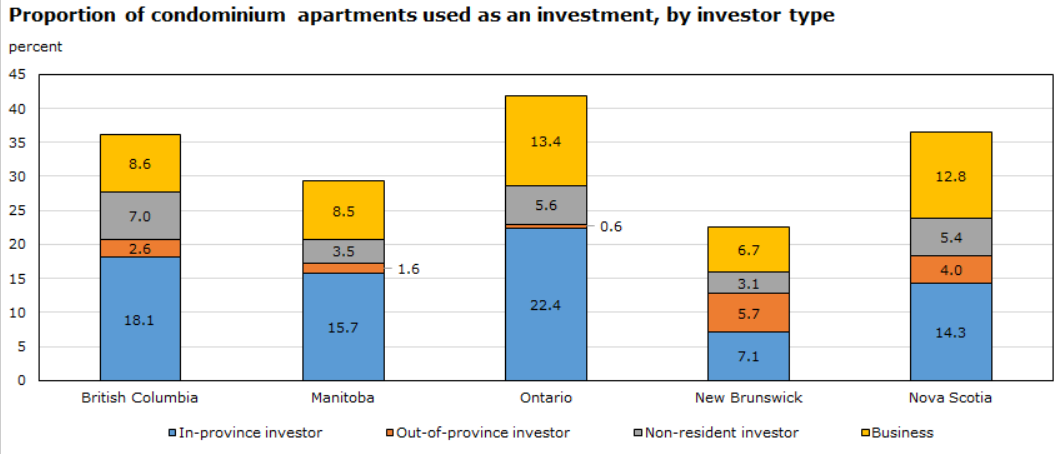

| Did you know? Houses were used as investments less frequently than condominium apartments. At 41.9%, Ontario topped the list as the province with the highest proportion of condos used as investments. |

Commercial Real Estate: Office Spaces, Retail, and Industrial Properties

Commercial real estate in Canada comprises properties used for business purposes. Some examples include:

- Office Spaces: Office spaces are dedicated areas where businesses conduct their operations. They can range from small individual offices to large corporate buildings, accommodating various sizes and types of companies.

- Retail Units: Retail properties consist of spaces where businesses sell products or services directly to consumers. They can include standalone stores, shopping malls, or storefronts in commercial buildings.

- Industrial Properties: Industrial properties are designed for manufacturing, warehousing, or distribution activities. These properties often feature specialized infrastructure and facilities to support industrial operations.

New Developments and Pre-Construction Properties

New developments and pre-construction properties refer to projects currently under construction or in the planning stages. These properties offer unique opportunities for buyers and investors:

- New Developments: New developments are residential or commercial projects that are newly constructed or undergoing significant renovations. They provide the advantage of modern designs, updated features, and the potential for customization.

- Pre-Construction Properties: Pre-construction properties are units or properties available for purchase before completion. Buyers can secure a property at a lower price than the market value, potentially benefiting from future appreciation.

Investment Properties: Duplexes, Triplexes, and Rental Properties

Investment properties are properties purchased to generate income through rental or resale. Some common types of investment properties in Canada include duplexes, triplexes, and rental properties.

Duplexes are residential buildings divided into two separate units, each with its entrance. Owners can live in one unit while renting out the other, creating a rental income stream. Triplexes are similar to duplexes but consist of three separate units. Owners can reside in one unit and rent out the other two or all three units to maximize rental income.

Rental properties encompass a wide range of residential or commercial properties rented out to tenants. Investors can choose to generate rental income from single-family homes, apartments, retail spaces, or office buildings.

Exploring the different types of real estate in Canada allows buyers and investors to make informed decisions based on their preferences, financial goals, and market conditions.

Navigating the Real Estate Market in Canada

In this article, we will provide insights on navigating the real estate market in Canada. We will discuss the buying and selling process, the purpose of real estate agents and brokers, mortgage options available in Canada, and the future outlook for the real estate market.

The Process of Buying and Selling Real Estate in Canada

Buying and selling real estate in Canada involves several key steps. Here is an overview of the process:

Process of Buying Property in Canada

- Determine your budget and financing options, considering mortgage options in Canada.

- Engage a real estate agent or broker to assist you in finding suitable properties.

- Visit properties, conduct inspections, and evaluate their suitability.

- Negotiate the purchase price and the details of the offer.

- Complete the necessary legal paperwork, including a purchase agreement.

- Secure financing and fulfill any conditions outlined in the contract.

- Close the transaction by finalizing the legal transfer of ownership and making the payment.

Process Selling Property in Canada:

- Determine the market value of your property through a professional appraisal or real estate agent’s guidance.

- List your property for sale through a real estate agent or online platforms.

- Market your property effectively to attract potential buyers.

- Negotiate offers and terms of the sale.

- Complete the necessary legal paperwork, including a sale agreement.

- Facilitate property inspections and address any conditions specified in the agreement.

- Close the transaction by transferring ownership and receiving the payment.

Real Estate Market: The Role of Real Estate Agents and Brokers

Real estate agents and brokers are vital in the Canadian real estate market. They provide valuable expertise, guidance, and support throughout the buying or selling. Here are some key responsibilities of real estate agents and brokers:

- Assisting buyers in finding suitable properties that meet their needs and budget.

- Providing sellers with market insights, pricing strategies, and marketing expertise to maximize their property’s exposure.

- Negotiating on behalf of their clients to achieve favourable purchase or sale terms.

- Facilitating communication and coordination between buyers, sellers, and other professionals involved in the transaction.

- Ensuring compliance with legal and regulatory requirements.

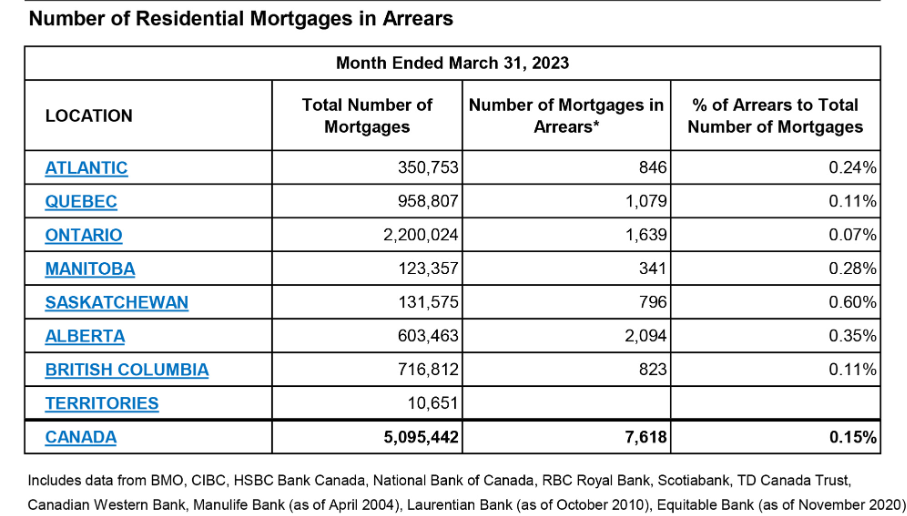

Understanding Mortgage Options in Canada

Mortgage options are an important consideration for property buyers in Canada. Here are some standard mortgage options available:

- Conventional Mortgages: These mortgages require a down payment of at least 20% of the property’s purchase price and are not insured by the government.

- High-Ratio Mortgages: These mortgages are for buyers with a down payment of less than 20% and require mortgage insurance to protect the lender.

- Fixed-Rate Mortgages: These types of mortgages have a fixed interest rate for a specified term, providing predictable mortgage payments.

- Variable-Rate Mortgages: These mortgages have an interest rate that fluctuates with market conditions, potentially resulting in changing mortgage payments.

The Future of Real Estate in Canada

The state of the economy, as reflected in indicators such as employment rates, interest rates, and GDP growth, profoundly impacts the demand for real estate. Favourable economic conditions, such as low unemployment rates and steady economic growth, can fuel confidence in the market and encourage investment in properties. Conversely, economic downturns or rising interest rates may dampen demand and affect property prices.

Also, changing demographics play a crucial role in shaping real estate trends. Factors such as population growth, shifting age demographics, and migration patterns can significantly impact the demand for different types of properties. For instance, regions experiencing population growth may witness increased demand for housing, while areas with an aging population may see a rise in demand for senior living facilities or downsizing options. Understanding demographic shifts is essential for real estate professionals and investors to identify emerging opportunities.

Technological advancements can potentially reshape the real estate industry in various ways. Innovations such as online property listings, virtual tours, and digital transaction platforms have transformed how properties are bought, sold, and managed. The increasing integration of artificial intelligence, data analytics, and smart home technology further enhances efficiency and convenience for property owners and occupants. Real estate professionals must adapt to these technological changes to stay competitive in the evolving market.

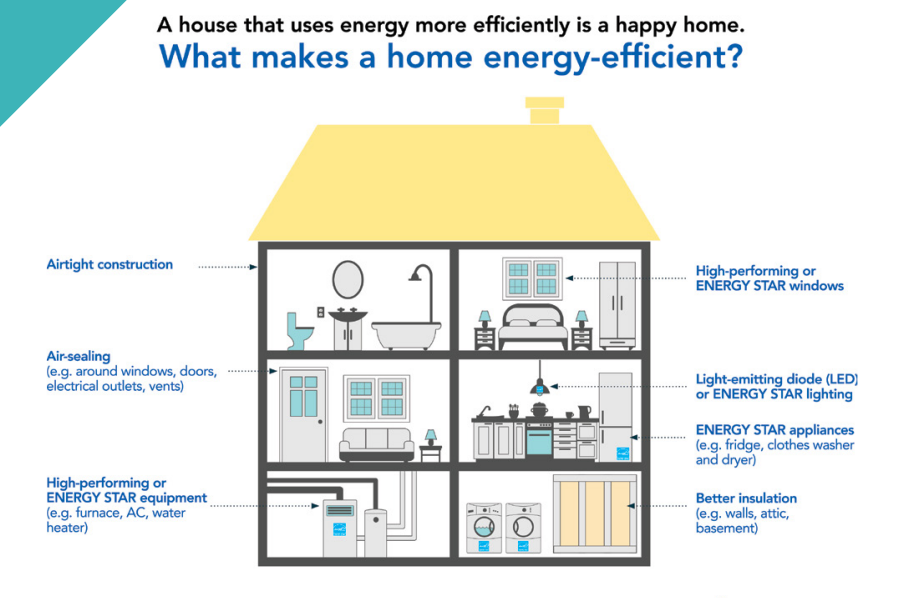

There has been a growing emphasis on sustainability and energy efficiency in the real estate sector in recent years. Green building practices, energy-efficient features, and environmentally friendly design are becoming more important for buyers and investors. Properties with sustainable features and certifications, such as LEED (Leadership in Energy and Environmental Design), can potentially command higher values and attract environmentally conscious buyers.

The focus on sustainability aligns with broader societal shifts towards a greener future and can significantly influence property values and buyer preferences.

Considering these factors and trends provides valuable insights into the future of Canada’s real estate market. By understanding the economic landscape, demographic changes, technological advancements, and sustainability considerations, industry professionals can make informed decisions and adapt their strategies to thrive in the ever-evolving real estate industry.

FAQ

How does the real estate market in Canada compare to other countries?

The Canadian real estate market has experienced steady growth, and its stability has attracted many investors.

What are the best cities for real estate investment in Canada?

Cities like Toronto, Vancouver, and Montreal are often considered prime locations for real estate investment due to their strong economies and vibrant housing markets.

How has the COVID-19 pandemic affected the real estate market in Canada?

The pandemic has brought some shifts in the real estate market, with fluctuations in demand, virtual viewings, and safety protocols influencing the buying and selling process.

Real Estate Canada – Final Thoughts

Navigating the real estate market in Canada requires a thorough understanding of the buying and selling process, the role of real estate professionals, available mortgage options, and future trends. By staying informed and working with knowledgeable professionals, individuals can make informed decisions and capitalize on the opportunities offered by the Canadian real estate market.