Are you ready to dive into Toronto’s real estate world in 2023? Uncover the compelling statistics and emerging trends that will empower you to make well-informed decisions. As the year unfolds, the Toronto real estate market is set to witness intriguing dynamics and trends.

From residential housing prices to commercial office spaces, understanding the real estate Toronto statistics and insights will be crucial for buyers, sellers, investors, and industry professionals. In this rapidly evolving landscape, keeping up with market trends, supply and demand dynamics, and government policies is essential for making informed decisions.

Join us as we delve into the statistics and trends shaping the Toronto real estate market in 2023, offering valuable insights into one of Canada’s most sought-after real estate destinations.

Table of Contents:

Overview of the Toronto Real Estate Market in 2023

In April, the Toronto real estate market displayed encouraging signs of recovery, with home prices experiencing a steady upward trend despite limited housing supply.

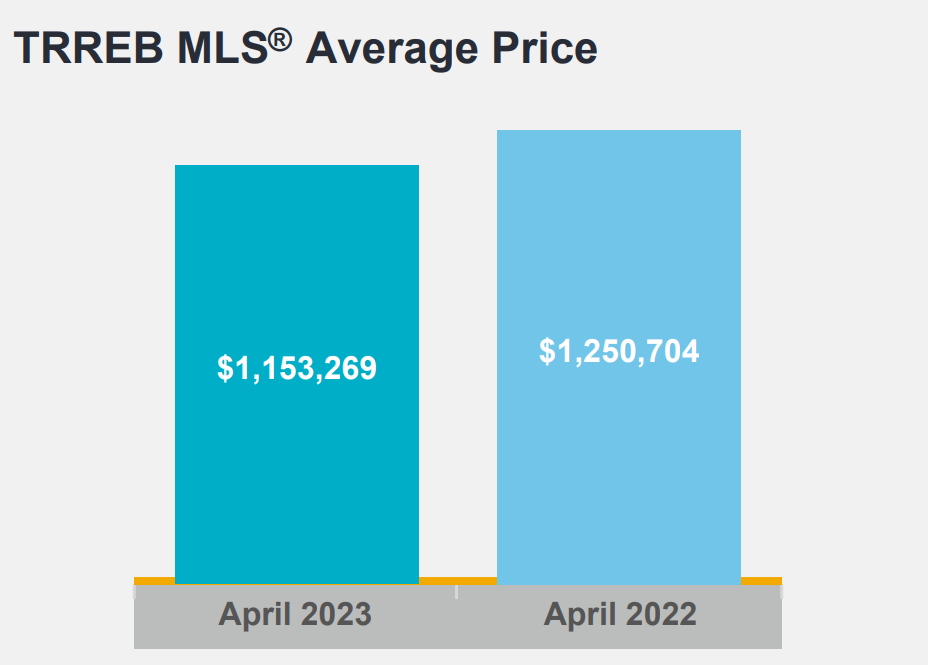

Although prices demonstrated positive momentum, it’s worth noting that they remained slightly lower than the average of $1.25 million recorded in April 2022. This suggests a year-on-year decrease in home prices in the GTA. However, the recent upward trajectory indicates a potential rebound and continued market resilience.

In terms of sales activity, the number of properties sold in April experienced a significant boost, rising approximately 9% compared to the previous month. A total of 7,531 properties changed hands, reflecting growing buyer confidence and heightened market activity. However, it’s important to acknowledge that year-on-year comparisons show a marginal decline of slightly over 5% in the number of properties sold.

These statistics indicate an evolving real estate landscape in Toronto, characterized by a gradual recovery from the impacts of the previous year.

| Did you know? According to the Toronto Regional Real Estate Board, the median value of homes in the Greater Toronto Area (GTA) rose for the third consecutive month, reaching $1.153 million. |

Key statistics for the Toronto real estate market in 2023

The Toronto real estate market is one of the most dynamic and diverse markets in Canada, with a wide range of property types, prices, and trends. Here are some key Toronto real estate market statistics for 2023, based on the latest data and forecasts available.

Housing prices in 2023

In April 2023, the average home sold price in the Greater Toronto Area (GTA) witnessed a year-on-year decline of 8.1%, settling at $1,153,269. However, this figure represented a 4% increase compared to the previous month and marked the highest level since May 2022.

Below, we’ll examine Toronto home prices in more detail.

Average Home Prices by Property Type

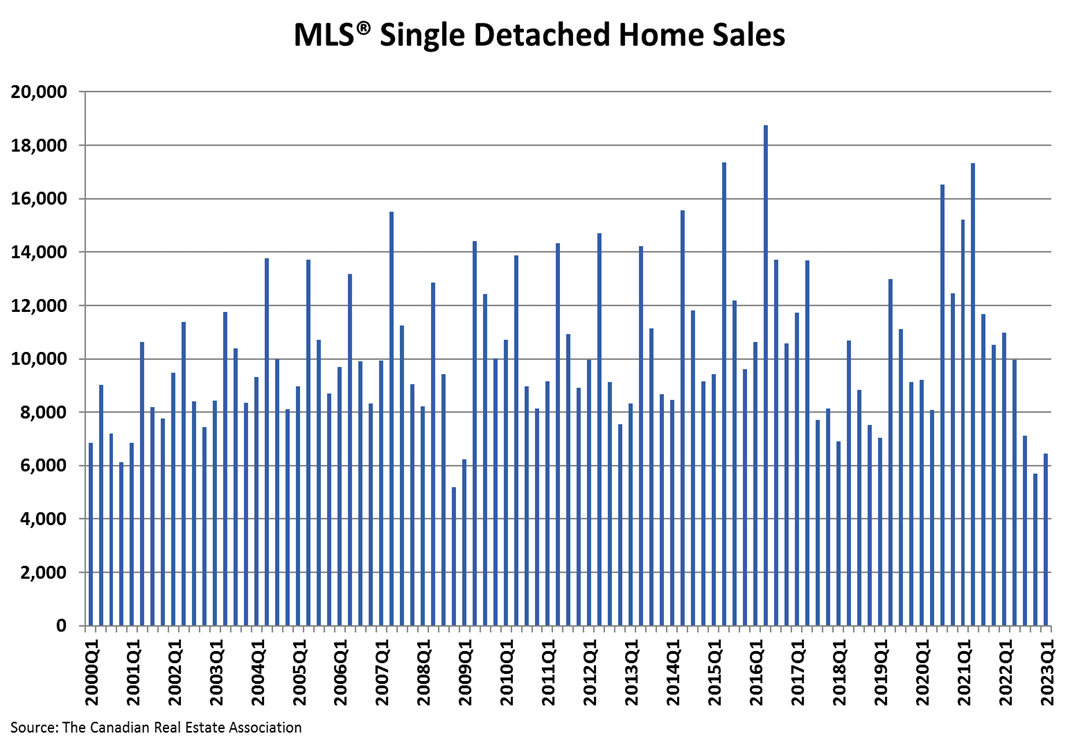

CREA’s report examines the sales data for single detached homes, semi-detached homes, condominium townhouses, and condo apartments, highlighting the sales trends and changes observed in the market.

- Single detached homes: In the first quarter of 2023, sales of single detached homes totaled 6,446 units, a significant decline from the corresponding period in 2022.

- Semi-detached homes: In the first quarter of 2023, sales of semi-detached units totaled 1,193 units, a significant decline from the same period in 2022.

- Condominium Townhouse: In the first quarter of 2023, sales of condominium townhouse units totaled 1,106 units, a significant decrease from the same quarter in 2022.

- Condo apartments: In the first quarter of 2023, sales of condominium apartments totaled 4,519 units, a significant decrease from the corresponding period in 2022.

Average Days on Market:

Days on market (DOM) is a statistic that measures how long a property stays on the market before being sold. A lower DOM indicates a faster and more competitive market, while a higher DOM suggests a slower and less active market.

According to the Toronto Real Estate Board (TREB) and CREA, the average DOM for all property types in the Greater Toronto Area (GTA) was 15 days in April 2023, down from 28 days in April 2022. The average DOM for different property types were as follows:

- Detached homes: 12 days, down from 26 days in April 2022.

- Semi-detached homes: 9 days, down from 21 days in April 2022.

- Townhouses: 16 days, down from 25 days in April 2022.

- Condominiums: 21 days, down from 34 days in April 2022.

Toronto real estate market trends in 2023

The Toronto real estate market is anticipated to witness notable trends and shifts in 2023, driven by factors such as changing housing preferences, affordability concerns, and the ongoing impact of the COVID-19 pandemic. Here are some of the Toronto real estate market trends in 2023.

The Greater Toronto housing market is expected to stay in balanced conditions through 2023. Demand in the area has been driven by move-up and move-over buyers, and this pattern is anticipated to continue in the upcoming year. The most common housing type is still single-detached homes, followed by condo apartments.

Key market trends for 2023 include rising interest rates and the price adjustments that follow, an increase in unemployment as a result of a slowing economy, and more opportunities for buyers and sellers to participate in the market as a result of more accessible prices. Less competition, lower prices, and more options on the market all benefit consumers.

Additionally, sellers will have the opportunity to trade up, experience less competition for listings, and become more likely to relocate to the suburbs.

| Did you know? Rising interest rates are expected to be a dominant theme in 2023, resulting in a slower market for both buyers and sellers. |

Factors Influencing and Shaping the Toronto Real Estate Market in 2023

The market is influenced by various factors, such as economic conditions, population growth, immigration, supply and demand, consumer preferences, and government policies. In 2023, the Toronto real estate market experienced some significant changes and trends that affected the performance and outlook of the market.

Interest rates

The Bank of Canada maintained its monetary policy and kept its overnight lending rate at 4.5%. The Bank is still ready to increase the policy rate further to reach its target. On June 7, 2023, the Bank of Canada is expected to make its next interest rate announcement. The higher interest rates increased the cost of borrowing and reduced the purchasing power and affordability of buyers, especially first-time buyers and investors.

Mortgage rules:

As borrowers turn to fixed-rate mortgages for slightly lower prices and overall stability, demand for variable-rate mortgages has fallen over the past year as a result of the Bank of Canada’s rapid rate hikes.

In the meantime, demand for fixed mortgage rates has slowly increased, with requests for five-year fixed mortgages accounting for 79% of all requests, up from 66% in 2022.

| Did you know? Recent data indicates that only 5% of all user submissions for five-year variable rates have been made so far in 2023, compared to 26% in 2022. |

Economic conditions:

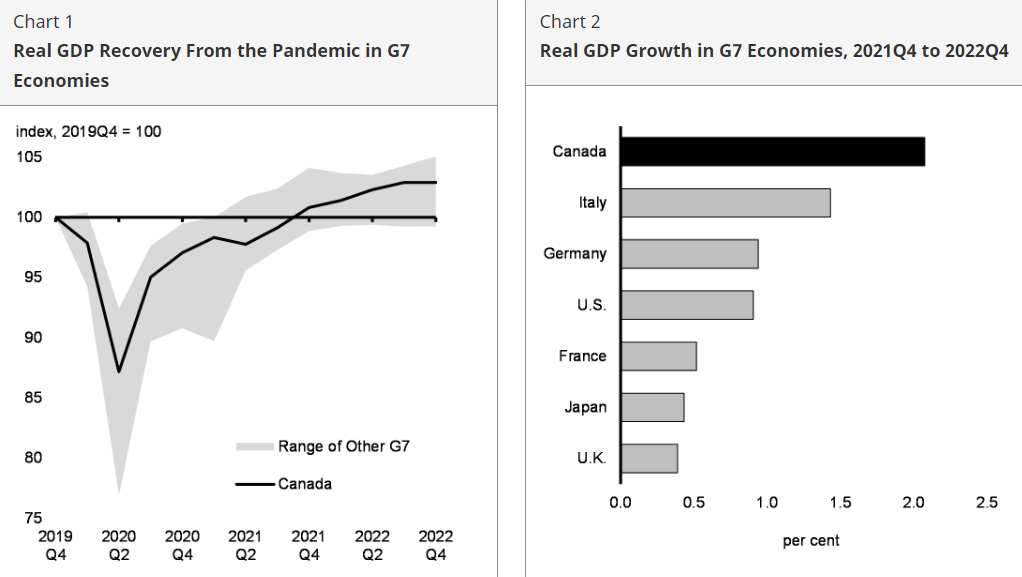

There is still a need for consistent efforts to build a sustainable and successful future for Canadians despite the fast-changing nature of the global economy. Strong population growth and strong household and corporate finances, both of which have received assistance from the government’s COVID-19 Economic Response Plan and Immigration Levels Plan, have contributed to this well-deserved economic development.

The improved economic conditions boosted consumer confidence and spending, as well as demand for housing.

| Did you know? Canada’s economy has recovered the fastest of the last four recessions, growing by 103% since the epidemic. |

Supply and demand:

The supply and demand dynamics of the Toronto real estate market improved in 2023, as both new listings and sales increased compared to 2022. This was mainly due to the easing of pandemic restrictions, the recovery of the economy, and the low-interest rates that stimulated buyer activity. The increased supply helped to moderate the price growth and improve the affordability for some segments of the market.

Residential Real Estate Trends in Toronto in 2023

Residential real estate trends in Toronto in 2023 are expected to reflect a combination of evolving buyer preferences, affordability challenges, and the ongoing effects of the COVID-19 pandemic. Potential trends may include a shift towards larger homes, increased demand for suburban properties, a focus on affordability measures, and a continued reliance on technology for virtual home tours and transactions.

Additionally, factors such as government policies, interest rates, and economic conditions will also play a significant role in shaping the residential real estate landscape in Toronto in 2023.

RE/MAX Canada anticipates that average residential sale prices will fall by 3.3% in 2023 across the country.

| Did you know? The total number of housing starts will decline in 2023 before rising in 2024 and 2025. Higher construction costs (regarding construction financing, labour, and materials) will limit construction activity. |

Toronto House Prices in 2023: An Analysis

As the real estate market in Toronto continues to evolve, analyzing house prices in 2023 provides valuable insights into the current trends and factors driving the housing market. In recent years, Toronto has experienced a robust housing market characterized by high demand and limited housing supply. This imbalance has contributed to consistent price growth, making the city’s real estate market highly competitive.

Analyzing Toronto house prices in 2023

As we mentioned earlier, in April 2023, the average home sold price in the GTA witnessed a year-on-year decline of 8.1%, settling at $1,153,269. According to some experts, Toronto house prices will recover in the second half of 2023 as interest rates stabilize and demand increases.

In March 2023, the housing market in the Greater Toronto Area (GTA) tightened, with sales accounting for an increased share of listings compared to March 2022. This suggests that competition between buyers is increasing. The average sale price was above the average list price for the first time since May 2022.

Consumer polling suggests that demand for ownership housing will continue to recover this year, with first-time buyers leading the recovery as high average rents move closer to the cost of ownership.

In March 2023 was reported 6,896 sales through TRREB’s MLS System, a decrease of 36.5% compared to March 2022. However, on a month-over-month basis, both actual and seasonally adjusted sales were up. New listings were also down on a year-over-year basis, indicating tighter market conditions compared to last year.

Lower inflation and greater uncertainty in financial markets have resulted in lower medium-term bond yields and lower fixed-rate borrowing costs. This will help with affordability as tighter market conditions exert upward pressure on selling prices in the second half of 2023.

According to RE/MAX Canada’s Toronto Housing Market Outlook 2023, the average price of a home in the region will drop to $1,061,853.91 next year, an 11.8 percent decline from the $1,203,916.00 average experienced between January 1, 2022 and October 31, 2022. The decline follows an 11 percent increase from 2021 to 2022.

Rental Market in Toronto: Statistics and Insights

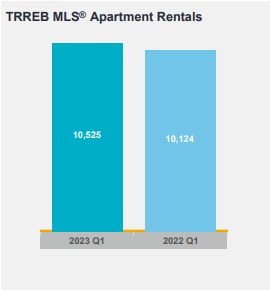

The rental market in Toronto faced continued pressure in the first quarter of 2023 due to strong population growth and high borrowing costs. Despite an increase in listings, the competition among renters remained fierce, leading to significant annual rent growth rates in the double digits or high single digits.

The rental market in Toronto is a dynamic and competitive sector that plays a significant role in the city’s housing landscape.

| Did you know? In Q1 2023, the GTA condo rental market was under pressure from high demand and low supply, resulting in steep rent increases. |

More condos were listed for rent, but not enough to meet the demand. Here are some key statistics and insights regarding the rental market in Toronto.

Rental Rates

Toronto has some of the highest rents in Canada. In May 2023, a 1-bedroom apartment cost $2,400 on average, up 17% from last year. A 2-bedroom apartment costs $3,000, down 3% from last year.

Vacancy Rates

Vacancy rate: The vacancy rate for condominium apartments decreased from 5.7% in Q4 2022 to 4.8% in Q4 2023, according to TRREB. The lower vacancy rate indicated that there was a strong demand for rental housing in Toronto, as more people moved to the city for work, education, or lifestyle reasons.

Rental Supply

The supply of rental housing in Toronto increased in 2023, as more purpose-built rental apartments and condominium apartments were completed or offered for rent. There were 24,789 new condominium apartment listings for rent in Toronto in Q2 2023, up from 21,571 in Q2 20223. The increase in rental supply indicated that there was a response from developers and investors to meet the growing demand for rental housing in Toronto.

Rental Regulations:

Toronto has rules to protect tenants and ensure fair and affordable housing. These include rent control, eviction limits, and the Landlord and Tenant Board. Both landlords and tenants should know these rules to avoid problems.

Commercial Real Estate Statistics in Toronto in 2023

As the year 2023 unfolds, it is essential for investors, businesses, and industry professionals to understand the commercial real estate statistics in Toronto. Commercial real estate is a vital sector of the economy, providing spaces for businesses to operate, grow, and innovate. It also offers opportunities for investors to generate income and capital appreciation, as well as for developers to create value and shape the urban landscape.

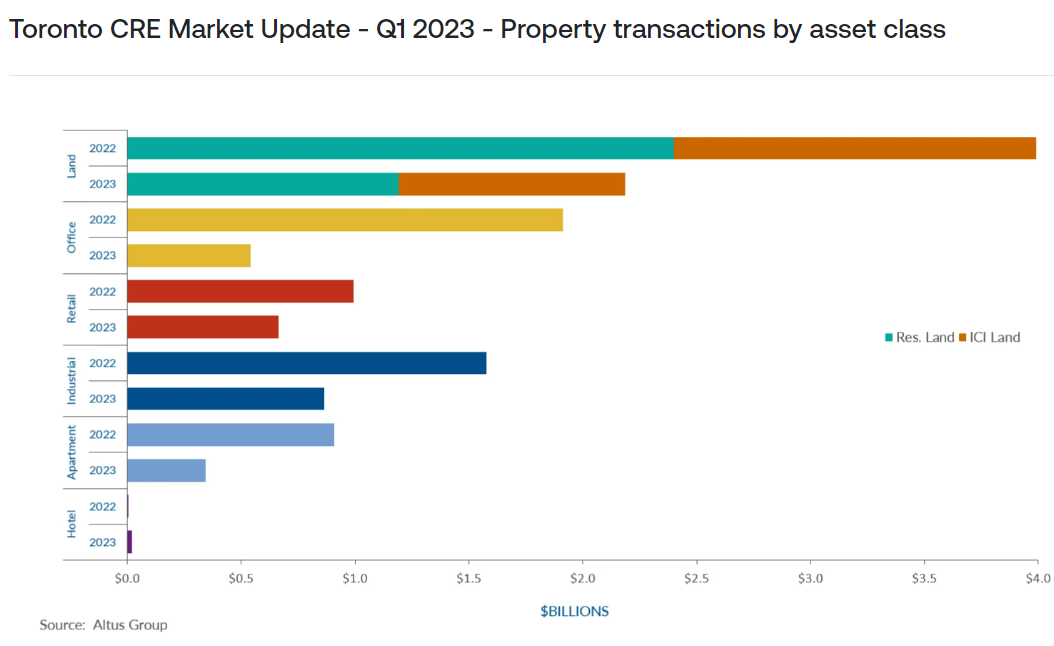

| Did you know? Commercial investment activity in the Greater Toronto Area amounted to $4.6 billion in Q1 2023, down about 50% from Q1 2022. |

The declining economy and the interest rate hikes that started in 2022 are to blame for this decline in activity. Investors and sellers are continuing to show caution while battling with price discovery due to the turbulent market conditions they must deal with.

Below, we will provide an overview of the commercial real estate statistics and trends that defined the market in 2023, focusing on four main sectors: office, industrial, land, and investment activity.

Commercial Property Prices in Toronto: An Overview

The investment activity in commercial property transactions in the GTA witnessed a significant decline in the first quarter of 2023, with the total volume amounting to $4.6 billion. This figure represents a 50% decrease compared to the same period in 2022. The decrease in investment activity can be attributed to various factors, including a slowing economy, the rapid increase in interest rates, and the uncertainty stemming from the COVID-19 pandemic.

The office sector saw a significant drop in investment transactions, from $1.9 billion in Q1 2022 to $0.5 billion in Q1 2023. This was largely due to the lack of major office deals, such as the sale of Royal Bank Plaza in Q1 2022. The office vacancy rate in Toronto increased to 13.6% at the end of 2022, as tenants relocated to new construction or reduced their space requirements. However, some investors remained optimistic about the office sector, as the return to office trend continued to emerge across some industries.

The industrial sector was the strongest performer among the improved property types, with $864 million in investment transactions in Q1 2023. This was still a 50% decrease from Q1 2022, but reflected the high demand and limited supply of industrial space in the GTA. The rental rate for industrial space rose by 39.6% year-over-year to $17.17 per sq. ft. at the end of 2022, the highest growth on record. The vacancy rate for purpose-built industrial space was 3.4% in October 2022, up from 1.5% in October 2021.

The land sectors (residential, ICI & residential lots) continued to dominate the GTA market, accounting for $2.21 billion or 48% of the total investment volume in Q1 2023. However, this was also a significant decrease from Q1 2022, when the land sectors represented $4.54 billion or 51% of the total investment volume. The demand for land was driven by the strong residential market, especially for low-rise housing types, as well as by the need for industrial development sites.

Understanding commercial property prices in Toronto in 2023

Commercial property prices in Toronto in 2023 are influenced by a variety of factors, including market conditions, location, property type, demand-supply dynamics, and economic trends. Here are some key factors to consider when understanding commercial property prices in Toronto in 2023, along with some examples and details:

- Location: Properties in prime areas like downtown Toronto or business districts have higher prices due to their access to amenities, transportation, and businesses. For example, properties in the Financial Core submarket had an average price of 41.9 Canadian dollars per square foot in Q1 2022, the second highest in the city.

- Property Type: Different property types have different market dynamics and demand patterns. High-demand sectors or emerging industries may have higher prices. For example, the industrial sector had a slight price increase from 2019 to 2023, due to the higher demand for industrial space from e-commerce, logistics and warehousing activities.

- Market Conditions: Supply and demand dynamics, vacancy rates, and investor sentiment can affect property prices. When demand is higher than supply, prices may rise, while a surplus of properties can lead to lower prices. For example, the office sector had the largest price decline from 2019 to 2023, due to the lower demand for office space from remote or hybrid work arrangements, and the oversupply of office space in the GTA.

- Economic Factors: GDP growth, employment rates, and interest rates can impact property prices. Positive economic conditions, a strong business environment, and steady job growth can increase demand and potentially prices.

- Rental Income Potential: The potential rental income that a property can generate is important for investors. High-demand areas with low vacancies and strong rental income prospects tend to have higher prices. For example, the Downtown South submarket had the highest rent for office space in Q1 2022, at 44.9 Canadian dollars per square foot.

Office Space Demand and Trends in Toronto in 2023

The office space demand in Toronto faced a challenging year in 2023, as the COVID-19 pandemic continued to affect the economy and the work patterns of many employees and employers. The demand for office space declined significantly, as more people opted for remote or hybrid work arrangements that reduced their need for physical office space.

The investment activity for office properties dropped sharply, as investors became more cautious and selective in their acquisitions.

Examining Office Space Demand and Trends in Toronto in 2023

The pandemic increased the adoption of remote and hybrid work models, as employers and employees enjoyed the benefits of working from home or elsewhere. Also, the supply of office space in Toronto rose significantly in 2023, as several new office projects were completed or near completion. According to Cushman & Wakefield, over 18 million sq. ft. of new office supply was expected for completion in 2023, of which over one-third was already committed to.

The demand and supply dynamics of office space varied across different sectors and regions within Toronto. Some sectors, such as technology, finance, and professional services, were more resilient and optimistic about their office needs, while others, such as retail, hospitality, and entertainment, were more affected by the pandemic and reduced their office footprint.

Some regions, such as downtown Toronto or established business districts, had higher demand and lower vacancy rates than others, such as suburban areas or emerging markets.

Insights into the Commercial Office Market in Toronto in 2023

The supply of office space in Toronto increased significantly in 2023, as several new office projects were completed or nearing completion. Some of the notable new office projects were Portland Commons, T3 Bayside, CIBC Square Phase 2, and The Well.

However, many tenants who moved into these new buildings left behind vacant or subleased space in their previous locations, adding to the oversupply of office space in the market. According to CBRE, the sublease availability rate in Toronto reached 6.7% in Q1 2023, up from 4.9% in Q1 2022. This indicated that many tenants were looking to reduce their office footprint or relocate to more affordable or flexible spaces.

FAQ

What are the current trends in the Toronto real estate market?

The Toronto real estate market in 2023 is expected to see modest price growth, supply and demand imbalance, shift in buyer preferences, rise of suburban markets, and condominium market adjustment. These trends are influenced by factors such as affordability, lifestyle changes, government regulations, and market conditions.

How do I find a reliable real estate agent in Toronto?

To find a reliable real estate agent in Toronto, you can ask for referrals, use a referral service, check their credentials and reputation, interview them, and choose the one who meets your criteria. A reliable agent can help you with your real estate transaction and provide you with professional advice.

What are the steps involved in buying a property in Toronto?

To buy a property in Toronto, you need to do your research, know your budget, get pre-approved for a mortgage, find a realtor, search for properties, make an offer, fulfill your conditions, prepare for closing, and move in. We recommend hiring a trustworthy realtor to help you with the process and make it more enjoyable.

How can I determine the value of my property in the Toronto market?

You can use online tools like Properly for an instant estimate, obtain a comparative market analysis (CMA) from a realtor, or hire a professional appraiser for a detailed and unbiased appraisal.

Real Estate Toronto – Final Words

The analysis of real estate Toronto statistics in 2023 provides valuable insights into the dynamics and trends of the city’s real estate market. Home prices, sales activity, property types, buyer preferences, rent levels, vacancy rates, and commercial investment are some of the key factors to consider. These statistics and trends can help make informed decisions in Toronto’s real estate market.