Choosing real estate investing in Canada, in their property sector, is a wise decision. The property market in Canada presents many prospects for astute investors seeking to increase their capital.

The alternatives are abundant if you’re contemplating acquiring rental properties, renovating run-down homes, providing private mortgages, or venturing into real estate ETFs. So, is investing in property profitable in Canada?

Let’s navigate the landscape of property investment in Canada and investigate the diverse pathways you can pursue to fully capitalize on this flourishing market.

Table of Contents:

What is Real Estate Investing?

Investing in real estate involves acquiring, leasing, renting out, and disposing of properties for financial gain. It’s an essential asset category that can notably diversify your investment portfolio. You can assemble a well-rounded portfolio that optimizes returns and reduces risks by integrating property with other investment options like equities, bonds, or digital currencies.

Various strategies exist for real estate investors to generate income. Some specialize in acquiring financially distressed or underpriced properties, restoring them, and then offloading them at an increased price. Others choose rental and holiday properties, accruing steady income through leasing. Industrial properties, such as storage facilities and office buildings, can yield substantial profits by leasing them to businesses and corporate entities.

For investors favouring a more indirect method, exchange-traded funds (ETFs) in real estate investment trusts (REITs) provide an avenue to profit from the property market without requiring direct property management.

| Did you know? An investment property is a property owned by at least one investor that is not the primary place of residence of any of the owners. |

How to Invest in Real Estate in Canada

The Canadian property market presents many investment opportunities designed to accommodate various needs, financial capabilities, and timetables. Whether your interest lies in active property management or a more laid-back approach, there’s something for every investor. Let’s delve into some prevalent investing methods in the Canadian real estate sector.

Buy a House: Building Equity and Making It Your Home

Homeownership is a common entry point into real estate investing for many Canadians, often without them realizing it. When you purchase a home, you’re securing a living space and initiating a long-term investment in equity. Equity is the difference between the market value of your home and the outstanding amount on your mortgage.

As you keep up with your mortgage repayments, your home’s value and, thus, your equity increases. This equity becomes a significant asset when you sell your property and might even qualify for capital gains tax exemptions if it’s your primary residence.

House Flipping

Property flipping means purchasing a home and selling it quickly for a profit. The act of flipping houses, popularised by various HGTV programs, has seized the attention of numerous hopeful real estate investors. The strategy involves:

- Buying an under-maintained property.

- Renovating it.

- Subsequently selling it at a higher price.

While the idea might sound appealing, it’s crucial to understand the substantial effort and risks involved. Pinpointing the perfect property, approximating refurbishment expenses, and ensuring a favourable return on investment can be challenging. However, meticulous planning and understanding of the local market can make this an advantageous pursuit.

Residential Rental Property Acquisition: The Path to Landlordship

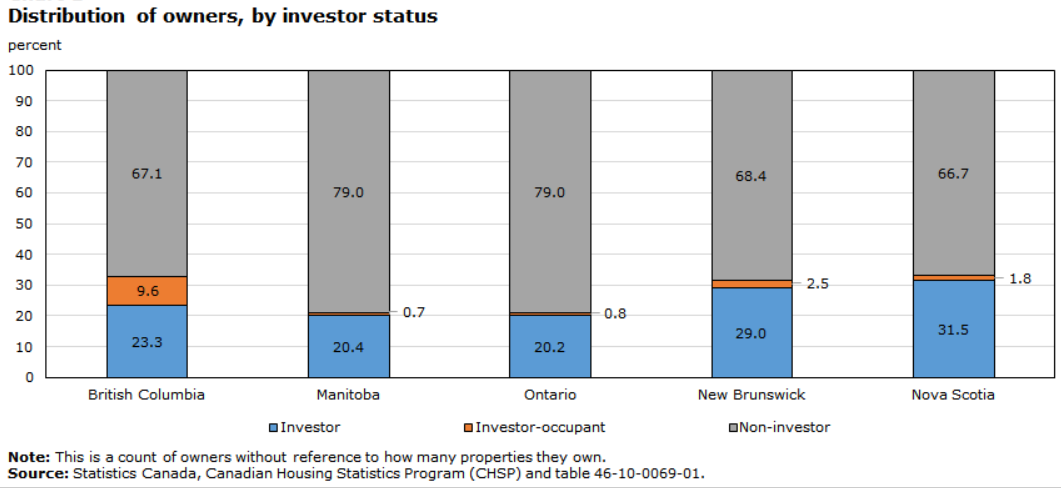

Investing in rental properties has seen a surge in interest as more Canadians choose to rent over the long term. Becoming a landlord entails buying properties such as standalone homes, condominiums, apartments, or townhouses and leasing them to tenants.

Rental income offers an extra cash stream, and the property’s long-term appreciation enhances your overall investment. Remember that managing rentals requires regular maintenance and higher mortgage rates than primary residences. Patience is critical with rental properties, as it may take a while to regain your initial investment.

| Did you know? If you want high-quality renters, you need to look for a property that is close to schools, hospitals, transportation companies, retail establishments, and so on. |

Commercial Real Estate Acquisition: Serving Business and Corporate Needs

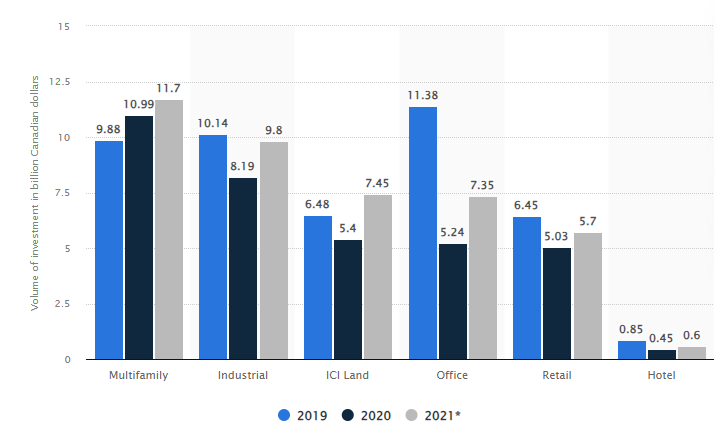

Commercial real estate provides a chance to invest in spaces designed for commercial and corporate use. This category includes shopping malls, office buildings, industrial parks, and supermarkets. However, entering this market generally demands a significant initial financial commitment, often reaching millions or even billions. While the entry barriers are high, the potential returns can be substantial for those with the necessary resources.

Investments in commercial real estate in Canada from 2019 to 2020, with a prediction for 2021, by sector:

Vacation Property Investment: Merging Leisure with Financial Gains

Investing in vacation properties like Airbnbs or B&Bs can yield monetary and personal rewards. Even renting a room in your primary residence can tap into the lucrative short-term rental market. For those with grander investment ambitions, acquiring vacation properties in sought-after Canadian spots such as Blue Mountain, Jasper National Park, or Niagara Falls can generate impressive profits.

Nonetheless, be prepared for associated expenses, including property upkeep, cleaning, and additional mortgage payments. Additionally, it’s crucial to factor in potential income variances during unpredictable periods.

| Did you know? The vast majority of short-term rentals are operated by big commercial operators rather than private individuals. |

Investing in Real Estate Investment Trusts (REITs): A Non-Hands-On Strategy

For those who prefer to avoid delving into the day-to-day of property management or navigating the complexities of property transactions, Real Estate Investment Trusts (REITs) provide a solution. REITs are corporations that own and oversee a collection of properties.

Investing in REITs allows you to combine your resources with other investors, letting the trust take on property management duties while you reap the financial rewards. REITs distribute dividends, providing a consistent income stream to bolster your regular earnings.

They also enable portfolio diversification, thereby mitigating risks linked to a specific geographic real estate market. Nevertheless, selecting a high-performing REIT is crucial to maximizing your return on investment.

Acquiring Land

Property investment has long been a favourite amongst Canadians. Echoing Mark Twain’s timeless wisdom, “Buy land. They don’t make it anymore.” This enduring advice remains relevant today. Land ownership presents multiple opportunities, from leasing for farming or leisure activities to selling for profit or construction purposes.

However, real estate investing extends beyond just land ownership. Other potential paths can assist in expanding your wealth and fortifying your financial stability.

Transitioning into a Private Mortgage Lender

For those exploring alternative strategies in real estate investing, taking on the role of a private mortgage lender could be an appealing option. In this capacity, you function as the lending institution, providing loans to homebuyers and applying an interest rate on the lent sum.

This can be a suitable alternative for individuals with poor credit ratings or failing to meet conventional mortgage criteria. As a private mortgage lender, you stand to gain more from your principal investment while aiding individuals in achieving their homeownership dreams.

4 Main Advantages of Investing in Real Estate

Real estate investment has long been esteemed as a practical and potentially profitable investment approach. Let’s examine the perks of real estate investing, encompassing prospects for long-term value appreciation, income generation, tax benefits, diversification options, and ownership of tangible assets.

1. Portfolio Diversification and Shield Against Market Fluctuations

A prime benefit of real estate investment lies in its capacity to add variety to your portfolio. Real estate values aren’t as tightly tied to stock market trends as equities are. Consequently, holding real estate assets can counterbalance losses and impart stability even amidst bearish markets, market adjustments, and other volatile periods.

2. Guard Against Inflation

Real estate assets also serve as a bulwark against inflation. As material costs rise, so do property prices and rents. This connection enables your total investments to surpass inflation rates, a factor that gains prominence as retirement nears.

3. Tax Advantages

The Canadian government views real estate endeavours as a business activity, offering a range of tax benefits. You can claim deductions on property taxes, depreciation, mortgage interest, and even maintenance and repair expenses as business costs, effectively diminishing your overall tax liability.

4. Positive Influence on Local Communities

Real estate investing isn’t solely about optimizing returns. It presents an opportunity to contribute positively to communities. Whether through investing in affordable homes or reviving a languishing rural area by introducing necessary facilities, such as a supermarket, real estate investments hold the potential to revamp and enhance local economies.

4 Challenges of Investing in Real Estate

Like any investment approach, real estate investing carries its own downsides and hurdles. Let’s delve into the challenges of real estate investing, encompassing high initial expenses, limited liquidity, demanding management and maintenance tasks, and the capricious nature of market trends.

1. Elevated Initial Expenses

Investing in real estate necessitates a substantial initial capital outlay. Even factoring in recent market adjustments in Canada, average home prices remain steep. Purchasing properties and carrying out essential repairs or upgrades require access to significant cash and credit lines.

2. Restricted Liquidity

Real estate is less liquid than equities or exchange-traded funds (ETFs). Selling a property isn’t as simple as offloading stocks; it encompasses listing the property, identifying buyers, negotiating terms, undergoing the mortgage process, and awaiting the closure of the sale. It could take years to recover your initial outlay, even with renting or leasing.

3. Demanding Property Management and Maintenance

Overseeing and maintaining properties can be time-intensive. Flipping houses and managing rental properties often become full-time responsibilities for real estate investors. While appointing a property manager is a possible solution, it incurs an additional expense. Moreover, property upkeep and repairs can be costly, necessitating the allocation of extra funds for unexpected outlays.

4. Volatile Market Conditions

While property prices have traditionally appreciated over the years, the market is unpredictable. Supply-demand dynamics, interest rates, and demographic shifts can significantly sway the market’s trajectory. Even if you currently invest in a booming market, there needs to be assurance it will sustain its momentum.

Understanding Real Estate Taxes in Canada

In Canada, a capital gains tax is levied when you dispose of a property at a value greater than what you initially invested. It’s crucial to note that the tax is triggered only when the property is sold, and till then, no capital gains taxes are levied.

Contrary to widespread belief, your total capital gains aren’t taxed at your marginal tax rate. Instead, only half of the capital gains are taxable. For instance, if you realized a profit of $100,000 from a house flipping project, only $50,000 would be subject to capital gains tax.

Additionally, it’s important to note that capital gains taxes are levied only on properties that don’t serve as your primary residence. You may be eligible for a tax exemption if you sell your principal home and register a profit.

Real Estate vs. Equity Investments

Equity investments and real estate possess some shared traits but also have distinct differences that may align differently with your investment style. Let’s dissect these differences.

With the emergence of online brokerages and robo-advisors, equity investments have become increasingly accessible. With just $1, you can start investing in equities, and the fees tied to online brokerages are typically minimal or non-existent. This accessibility renders equities a feasible option for investors with limited resources.

Compared to equities, real estate is more challenging to convert into cash. Unlike the equity market, which guarantees buyers for each seller, real estate investors must proactively find buyers, negotiate prices, and finalize the sale to mobilize funds.

Equity investing often requires a sound understanding of diverse investing strategies and principles. It may necessitate analyzing financial statements, keeping abreast of economic news, and making informed choices. Conversely, real estate investing typically demands less technical knowledge.

Although there are strategies to master, the focus often lies in identifying the right location to maximize value appreciation.

Is Real Estate a Profitable Investment in Canada?

Including real estate in your investment portfolio can be a strategic decision. It delivers diversification, tax advantages, and potential for steady income streams that can support you post-retirement. However, like any investment, it carries risks. While the returns from real estate investing can be substantial, losses can also be considerable. Moreover, the ongoing maintenance and preservation of properties, especially in areas prone to severe weather, can become burdensome over time.

For beginner investors, a less active strategy might be more desirable. Real estate exchange-traded funds (ETFs) and real estate investment trusts (REITs) offer exposure to the real estate sector without requiring direct property acquisition. This choice can be desirable considering the current state of the residential and commercial real estate sectors, which might seem unaffordable to many Canadians.

FAQ

What is real estate investing?

Real estate investing involves acquiring, leasing, renting, and disposing of properties for financial gain. It is an asset category that can diversify an investment portfolio and provide opportunities for long-term value appreciation and income generation.

What are some strategies for real estate investing?

Real estate investors employ various strategies, such as buying financially distressed properties, renovating and selling them for a profit (house flipping), investing in rental properties for long-term income, leasing commercial real estate, acquiring vacation properties, investing in real estate ETFs and REITs, and becoming a private mortgage lender.

How can I invest in real estate in Canada?

The Canadian property market offers diverse investment opportunities. You can invest by buying a house for homeownership and building equity, flipping houses for quick profits, acquiring rental properties for long-term income, investing in commercial real estate, purchasing vacation properties, investing in REITs through real estate ETFs, acquiring land, or transitioning into a private mortgage lender.

What are the advantages of real estate investing?

Real estate investing provides portfolio diversification, protection against market fluctuations, a hedge against inflation, tax advantages (deductions on property taxes, depreciation, mortgage interest, etc.), and the opportunity to positively influence local communities through investment in affordable housing and infrastructure.

What are the challenges of real estate investing?

Real estate investing comes with challenges, including high initial expenses, limited liquidity (compared to equities), demanding property management and maintenance tasks, and the unpredictability of market trends and conditions.

How are real estate taxes in Canada handled?

In Canada, capital gains tax is levied when you sell a property at a higher value than your initial investment. Only half of the capital gains are taxable, and the tax is triggered only upon the sale of the property. Capital gains taxes apply to properties that are not your primary residence, but there may be exemptions available for selling your principal home at a profit.

What are the differences between real estate and equity investments?

Real estate and equity investments have similarities but also distinct differences. Real estate is less liquid than equities and requires proactive efforts to sell and convert into cash. Equity investing often requires a deeper understanding of investment strategies and financial analysis, while real estate investing focuses more on location and value appreciation.

Is real estate a profitable investment in Canada?

Real estate can be a profitable investment in Canada, offering opportunities for long-term value appreciation, steady income streams, and tax advantages. However, it also carries risks, and ongoing property maintenance can be burdensome. For beginner investors, real estate ETFs and REITs provide a more passive strategy to gain exposure to the real estate sector without direct property ownership.

Real Estate Investing in Canada – Final Words

Real estate investing can provide rewarding opportunities and advantages, but it’s essential to have a robust understanding of the market and thoroughly assess your choices.

Whether you decide to invest actively or favour a more passive strategy, real estate can benefit your investment approach, aiding you in expanding your wealth and securing a prosperous financial future.