Welcome to the dynamic realm of pre construction commercial real estate, where the seeds of innovation are sown, and the blueprint of possibility unfolds. In this vibrant landscape, every vacant lot holds the promise of transformation, and every decision shapes the trajectory of success.

Who is this guide for? It is for those individuals who are looking to develop (and invest) into pre-construction commercial properties.

As we embark on this journey through the intricate dance of site selection, due diligence, financial orchestration, and collaborative expertise, we’ll uncover the art and science behind turning visions into thriving realities. Join us as we delve into the heart of pre-construction, where dreams become blueprints and aspirations take shape one calculated step at a time.

Table of Contents:

Importance and Relevance in Today’s Market

In today’s dynamic real estate market, where demand and competition are continually evolving, the significance of pre-construction commercial real estate cannot be overstated. The careful assessment of site selection and thorough due diligence mitigate potential risks, enhance feasibility, and increase the overall success rate of a project.

Investors and developers recognize that investing time, effort, and resources into the pre-construction phase can yield substantial dividends in the long run.

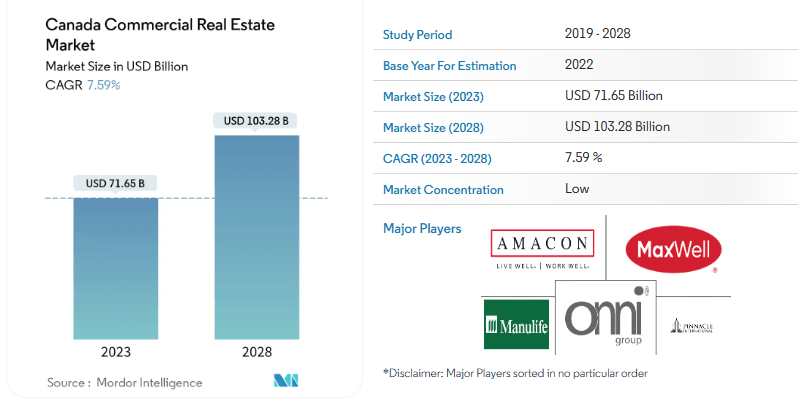

| Did you know? Canada Commercial Real Estate Market size is estimated at USD 71.65 billion in 2023, and is expected to reach USD 103.28 billion by 2028 |

3 Steps of The Pre-Construction Process

Where do you start? Before breaking ground on a commercial real estate development project, a comprehensive pre-construction process is essential to set the stage for success. This phase involves a series of critical steps that collectively determine the feasibility, viability, and potential challenges associated with the project.

1. Site Selection and Evaluation

Property size, visibility, traffic flow, and demographics significantly determine the site’s potential. A thorough evaluation of the surrounding infrastructure and potential access points is crucial for ensuring the location aligns with the project’s objectives. Moreover, understanding zoning restrictions is essential to avoid conflicts and obstacles during development.

2. Due Diligence and Research

Due diligence is a meticulous process involving extensive research and assessment of the chosen site’s legal requirements, risks, and advantages. This includes delving into zoning restrictions to understand how the property can be used within local regulations. Identifying any liens or encroachments on the property is vital to prevent future legal complications.

3. Site Investigation Reports / Feasibility Study

Site investigation reports or feasibility studies are instrumental in gauging the project’s practicality. These studies delve into various aspects, such as land use and zoning regulations, engineering requirements, permits, and utilities. Developers can identify potential challenges early on by conducting a feasibility study and make informed decisions regarding the project’s scope, cost, and overall viability.

Integrating environmental consultants during the feasibility study phase can help assess potential environmental impacts and ensure compliance with relevant regulations.

By adhering to these pre-construction steps, developers and investors can optimize their decision-making process, mitigate risks, and lay a strong foundation for a successful commercial real estate development project.

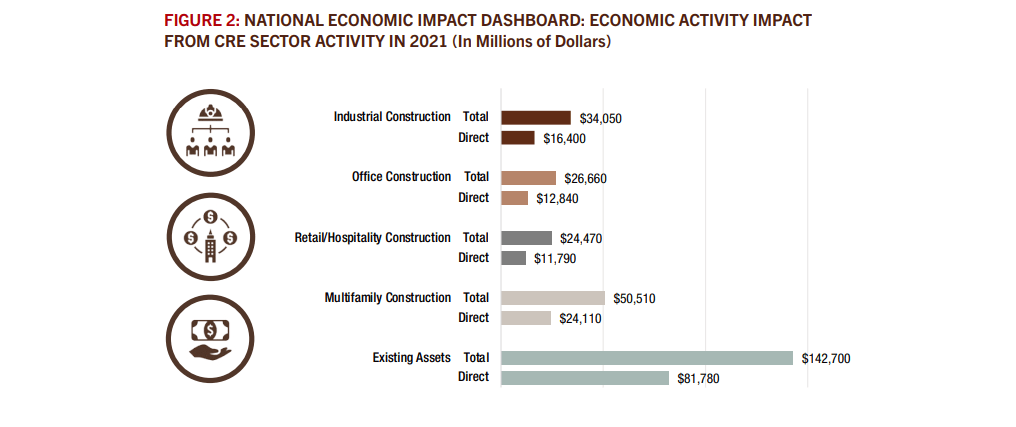

| Did you know? In 2021, the commercial real estate sector’s building construction investments and ongoing operations contributed $148.4 billion to Canada’s GDP. The contribution of the CRE industry to Canada’s GDP is comparable to that of the oil and gas sector. |

Key Players and Stakeholders in Pre-Construction

The successful execution of a pre-construction phase in commercial real estate development requires collaborating with various key players and stakeholders. These experts bring unique skills and perspectives to ensure the project progresses smoothly from concept to reality.

Architects, Civil Engineers, Site Planners, Attorneys

Architects are pivotal in translating the project’s vision into feasible designs that align with zoning regulations and market demand. Civil engineers bring their technical expertise, ensuring the site can support the proposed structure and its utilities. Site planners analyze the site’s layout and optimize it for functionality and aesthetic appeal. Attorneys specializing in real estate law navigate legal complexities, ensuring the project adheres to local regulations and mitigates potential legal risks.

Environmental Consultants, Surveyors, Title Companies, Lenders

Environmental consultants assess potential environmental impacts, helping the project meet environmental regulations and sustainability goals.

Surveyors accurately measure and map the site, providing essential data for design and planning. Title companies ensure that the property’s title is clear of any encumbrances. Lenders provide the necessary financing for the project, evaluating its feasibility and potential for return on investment.

This collaborative effort ensures that all aspects of the pre-construction phase are addressed comprehensively, setting the stage for a successful commercial real estate development project.

Financial Considerations

In commercial real estate development, navigating the financial landscape during the pre-construction phase is critical. Several financial aspects come into play, each contributing to the overall feasibility and success of the project. Let’s delve into the key financial considerations that shape the pre-construction phase.

| Did you know? Canada construction market size was $355.9 billion in 2022. The market is projected to achieve an AAGR of more than 1% during 2024-2027. |

Land Purchase & Acquisition Costs

Acquiring a suitable parcel of land is the foundation of any commercial real estate project. Land purchase and acquisition costs involve various financial components, including the cost of acquiring the land itself, a significant expense that sets the groundwork for the entire project.

Site location, visibility, and proximity to essential amenities impact the land’s price. Conducting due diligence incurs costs associated with surveys, environmental assessments, and legal reviews. Aligning the land purchase with market demand influences its valuation. This intricate interplay of factors shapes the financial landscape of the pre-construction phase, necessitating careful consideration and analysis.

Finance Costs, Professional Fees, Utility Connection Fees

Finance costs include interest rates, loan origination fees, and other financial charges for securing project financing. Professional fees cover architectural and engineering design, legal, and consultancy expenses.

Utility connection fees encompass the costs for connecting the project to essential utilities like water, electricity, and sewage. These financial aspects intertwine, collectively shaping the fiscal framework that underpins the successful progression of the pre-construction phase.

| Did you know? Construction industry is an important economic driver for Canada as well as an indicator of the strength of the nation’s economy. |

Impact Fees, Permit and Review Fees, Construction Costs

As the project advances, additional financial considerations emerge, directly impacting the project’s viability and cost estimation. Impact fees are charges imposed by municipalities to cover the project’s strain on local infrastructure and services.

Permit and review fees encompass the costs associated with obtaining necessary permits and undergoing regulatory reviews, contributing to the overall budget. Construction costs, influenced by pre-construction estimates, play a pivotal role during the transition to the construction phase. Incorporating these financial factors into the pre-construction phase ensures a well-rounded understanding of the project’s budgetary requirements.

Each cost element must be meticulously assessed and accounted for to prevent budget overruns and project delays. This comprehensive approach to financial planning safeguards the project’s successful execution and aligns it with market demand and regulatory requirements.

FAQ

Why invest in pre construction commercial real estate?

Investing in pre-construction can offer a lower purchase price, potential for appreciation as the project nears completion, and the ability to customize the space to fit specific business needs.

What are the risks associated with pre construction investments?

Risks include construction delays, changes in market conditions, potential changes in the final product, and the possibility of the project not being completed.

Can I customize my commercial space during the pre construction phase?

Developers often allow buyers to customize their spaces during the pre-construction phase, but discussing and confirming any modifications with the developer beforehand is essential.

How do I finance a pre-construction commercial property?

Financing options may include traditional bank loans, developer financing, or seeking investors. It’s crucial to consult with a financial advisor or lender to explore the best options for your situation.

What happens if the project is delayed or not completed?

Contracts for pre-construction properties typically include clauses that address delays and non-completion. Reviewing these clauses and understanding your rights and potential remedies is essential.

How do I ensure the quality of the construction?

Researching the developer’s track record, visiting their past projects, and reviewing any warranties or guarantees they offer can help ensure the quality of the construction.

Are there any tax benefits to investing in pre construction commercial real estate?

Tax benefits, such as depreciation or tax credits, may be associated with investing in commercial real estate. It’s advisable to consult with a tax professional to understand the specific benefits for your situation.

How long does the pre construction phase typically last?

The duration of the pre-construction phase can vary based on the project’s size, complexity, and other factors. It’s essential to get an estimated timeline from the developer.

Can I sell my pre construction commercial property before it’s completed?

This is known as “flipping” a pre-construction property. While possible, there may be restrictions or penalties for doing so. Review your contract and consult with a real estate professional before deciding.

Pre Construction Commercial Real Estate – Final Words

As we bring our exploration of pre construction commercial real estate to a close, we stand at the threshold of possibility. The intricate steps we’ve unveiled, from meticulous site selection to financial choreography, lay the groundwork for more than just structures. They shape the future of communities, economies, and aspirations.

In a world where innovation meets regulation, where both architectural genius and fiscal prudence shape dreams, the pre construction phase emerges as a testament to human ingenuity. The collaboration of architects, engineers, consultants, and stakeholders, each playing their unique role, ignites a symphony that transcends blueprints and steel.

From the concept’s inception to unveiling a grand opening, pre construction is the canvas upon which aspirations are painted, one stroke at a time. As the market evolves and demands change, regulations adapt and financial landscapes shift, the principles we’ve unearthed stand as enduring pillars of success.

So, whether you’re an investor, a developer, or an enthusiast of the built environment, remember that pre construction is more than just a phase—it’s a journey. It’s the journey of turning possibility into reality, translating dreams into tangible structures, and crafting the future, one brick at a time.