Owning a home is a tremendous achievement, but maintaining homeownership can be difficult when burdened with crushing debt. Debt and homeownership have a complicated connection, and knowing its impacts is crucial. We are here to help answer the question of how to keep your house while in financial trouble.

While taking out a mortgage increases your equity, other sorts of debt may accumulate and threaten your ability to maintain your house. This article will look at the impact of debt on homeownership, clarify popular misconceptions, dig into debt management solutions, and look at legal options to help you save your beloved home.

Table of Contents:

Understanding Debt and Homeownership

Debt can significantly impact homeownership, and it is crucial to understand the relationship between the two. When you take on a mortgage to purchase a home, you borrow money from a lender to finance the purchase. Over time, as you make your monthly mortgage payments, you gradually build equity in your home.

However, other types of debt, such as credit card, personal, or student loans, can accumulate and create financial challenges that may threaten your ability to maintain homeownership. Excessive debt poses risks and consequences for homeownership.

Meeting financial obligations, including mortgage payments, becomes increasingly difficult when drowning in debt. High-interest rates further complicate debt management and homeownership. Keeping up with monthly debt payments becomes challenging, especially with multiple debts.

| Did you know? After taxes, the average Canadian owes around $1.70 for every dollar earned. |

Impact of High Debt on Homeownership

High debt levels have a major influence on homeownership in the short and long term. Excessive debt raises the possibility of falling behind on mortgage payments, which can lead to foreclosure and property loss. It also negatively affects your credit score, limits financial flexibility, and adds stress to your life. Understanding these consequences is critical for taking proactive steps to maintain homeownership while handling high debt levels.

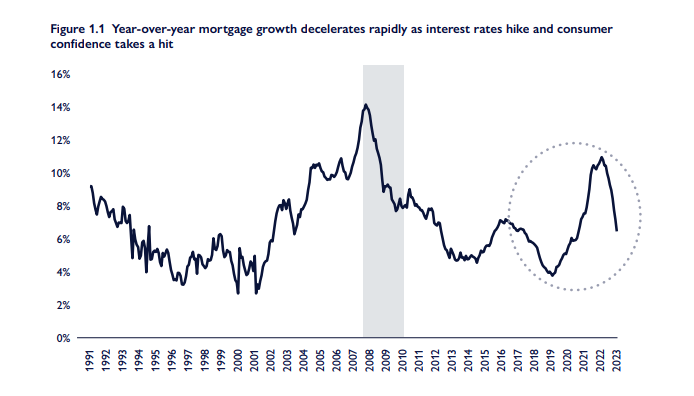

| Did you know? Despite slower mortgage growth, Canadian homeowners are still faced with record amounts of mortgage debt. Canada’s debt-to-income ratio has risen to 180.7%. |

4 Common Misconceptions About Losing Your House Due to Debt

There are several common misconceptions about the possibility of losing your house due to debt. It is crucial to clear up these myths and give correct information to help homeowners make informed financial decisions. Let us examine and debunk these misconceptions.

Misconception 1: Debt automatically leads to foreclosure

One common misconception is that accumulating debt automatically leads to the loss of your property through foreclosure. While it is true that missed mortgage payments can lead to foreclosure, it is vital to remember that this process takes time. Foreclosure is a legal practice that requires a specific timeline and set of conditions to be met.

It is crucial to take proactive steps when dealing with debt by getting professional assistance, exploring debt management strategies, and communicating with your lenders. By taking these steps, you can significantly reduce the risk of foreclosure and create opportunities for alternative solutions to protect your homeownership.

Misconception 2: Selling your home is the only solution

People often think selling their homes is the only way to escape the debt burden. Even though selling your home may be an option in some cases, other solutions also exist. Many homeowners have gotten through tough financial times by exploring different strategies to preserve their homes.

It’s necessary to think about the long-term effects of selling your home, such as how it will affect your family, how it will change your life, and whether or not there will be transaction costs. Before making such a big choice, it’s best to consider all the options and talk to a professional to figure out the best way to move forward.

Misconception 3: Bankruptcy is the end of homeownership

People with too much debt often see bankruptcy as their last option. A common misperception is that you will automatically lose your house if you file for bankruptcy. Bankruptcy laws vary from place to place, and there are ways for people to keep their homes while restructuring their debt.

Misconception 4: Lenders have no flexibility or willingness to negotiate

When confronted with excessive debt, some homeowners might think lenders need more flexibility or willingness to negotiate. However, this is not always the case. Lenders understand that foreclosure benefits neither side and may be open to finding other solutions.

By proactively communicating with your lenders and addressing your financial situation, you can discover options such as loan modification, temporary forbearance, or repayment plans that might assist you in navigating difficult times while keeping your property. Effective communication and showing a real commitment to resolving your financial problem could increase your chances of reaching a mutually beneficial solution with your lender.

Exploring Debt Management Strategies

Researching debt management solutions is crucial to maintaining homeownership when faced with overwhelming debt. Homeowners can take control of their financial situation and work toward keeping their homes by applying an efficient debt management strategy. Let’s examine two popular debt-management strategies:

Consolidating Your Debt: A Way to Keep Your House?

Debt consolidation is a good strategy for helping homeowners to simplify their financial obligations. Individuals can simplify their monthly payments by joining multiple debts into a single loan, making them more manageable.

| Did you know? Consolidation loans come in different forms, such as personal loans, home equity loans, or balance transfers to credit cards with lower interest rates. |

The goal is to secure a loan with better terms, allowing homeowners to pay off their debts more efficiently. Individuals who consolidate their debts can focus on a single payment and save money on interest payments. This approach offers a structured repayment plan tailored to the homeowner’s financial abilities, ultimately helping them regain stability and preserve their homeownership.

The Role of Debt Counseling in Preserving Homeownership

Debt counselling plays a crucial role in helping homeowners navigate through challenging financial circumstances. Seeking assistance from a certified credit counsellor can provide valuable guidance, support, and education on managing debt while preserving homeownership.

Debt counsellors work closely with individuals to analyze their financial situation, assess their debt obligations, and develop personalized plans for debt repayment. They can provide insights into budgeting, negotiation strategies with creditors, and ways to reduce expenses to free up more funds for mortgage payments.

Furthermore, debt counselling services can give homeowners a comprehensive understanding of their financial options. They can explore alternative solutions, such as debt management plans or debt settlement programs, which may help reduce the overall debt burden and keep the house.

| Did you know? A recent randomized field trial demonstrated that free quarterly “telephone financial coaching” for one year after a home purchase reduced mortgage default rates by 11.1% for first-time home buyers with subprime credit history (credit scores below 680). |

Legal Options to Keep Your Home

When faced with excessive debt, it is important to examine legal options to assist homeowners in keeping their homes. Understanding available legal options and their implications can help people make informed choices. Let’s look at two standard legal options:

Understanding Bankruptcy’s Role in Keeping Your House

Bankruptcy can be a viable solution to help homeowners keep their homes. Chapter 13 bankruptcy, for instance, offers a repayment plan that allows homeowners to catch up on missed mortgage payments and potentially keep their homes. Bankruptcy should be seen as a tool for financial rehabilitation rather than the end of homeownership.

Consulting with a bankruptcy attorney is essential to navigate the process effectively and it can increase your chances of keeping your home.

Pros and Cons of Loan Modification Programs

Loan modification programs provide a solution for struggling homeowners. These programs involve working with lenders to adjust loan terms in order to make them more affordable. While it can help to relieve and prevent foreclosure, homeowners should examine the effects on their credit scores, loan conditions, and fees.

Seeking advice and guidance from a housing counsellor or an attorney experienced in loan modification might help you make a well-informed decision. Understanding the legal options available is necessary for homeowners trying to maintain their homes while managing debt.

Bankruptcy and loan modification programs provide potential avenues for maintaining homeownership, and consulting professionals are crucial for navigating these processes successfully.

3 Practical Steps on How to Keep House While Drowning in Debt

If you are determined to maintain your home while dealing with financial challenges, there are practical steps on how to keep your house while drowning in debt as you navigate the complex financial situation that you find yourself in. By taking these steps, you can take control of your finances and move towards a more stable future.

1. Prioritize Your Mortgage Payments

When faced with overwhelming debt, it’s essential to prioritize your mortgage payments above all other financial obligations. Your home is probably your most valuable possession, as well as a place of security for you and your family. Prioritizing mortgage payments ensures that you are taking proactive actions to maintain your homeownership.

Consider making a monthly budget for essential expenses such as mortgage payments, electricity, and other basic living expenses. Reduce unnecessary costs whenever feasible to save up money for your mortgage payments. This demonstrates your dedication to keeping your home and can help you negotiate with creditors.

Also, seek professional guidance. Professionals can help you create a plan to pay off your debt and provide assistance on how to manage your finances in the future.

2. Negotiating with Your Lenders: A Crucial Step

The value of open and honest communication with your lenders should not be underestimated. If you need assistance in meeting your financial obligations, please contact them as soon as possible. Explain your circumstances, demonstrate commitment to fixing the problem, and consider negotiating with lenders to find options that will allow you to keep your home.

Both the lender and the borrower stand to lose from a foreclosure. Lenders may be willing to discuss terms that work for both sides. Forbearance, loan modification, and different payment plans are all options to make your loan payments more manageable. Starting these discussions on time will help you figure out an option that allows you to keep your property.

3. Selling Your Property and Buying a More Affordable Option

In some cases, selling your home and downsizing to a more affordable option may be an effective solution for reducing debt while keeping a roof over your head. You can lower your monthly mortgage payments and living expenses by selling your present property and finding a more affordable home. Also, the role of real estate agents in house debt can be very important.

Working with a financial advisor and an agent that is experienced in distressed properties and affordable housing might be helpful. Real estate agents help you find suitable options in your preferred location and negotiate favourable terms. Remember that selling your home is a huge decision, and you should think about market conditions, potential transaction costs, and the impact on your lifestyle.

FAQ

What are the first steps I should take to keep my house when I’m in significant debt?

If you’re deeply in debt and want to keep your house, first analyze your finances and see if you can afford mortgage payments. If you’re having trouble paying, contact your lender immediately to discuss debt modification or repayment choices.

How can a real estate agent help me keep my house when I’m in debt?

Real estate agents can give you guidance if you’re considering selling your home to reduce debt, helping you determine its market value and find a buyer. An agent can assist you in finding acceptable possibilities and negotiating favourable conditions if you are downsizing to a more affordable house. It’s important to find an agent experienced in distressed properties and affordable housing.

What options can a real estate agent suggest if I can’t keep my house due to debt?

Real estate agents can suggest finding a more affordable home if you choose to downsize. Additionally, an agent may be able to connect you with resources such as financial consultants or credit counsellors that can help you manage your debt and find a sustainable housing solution.

Can a real estate agent help me with a short sale if I can’t afford to keep my home?

Yes, if you can’t afford to keep your home, a real estate agent can help you with a short sale. A short sale happens when a property is sold for less than the outstanding mortgage balance. For homeowners who are facing foreclosure and are unable to make their mortgage payments, This can be a viable option.

What is the role of a real estate agent in a foreclosure situation?

A real estate agent’s duty in a foreclosure situation is to assist the homeowner in selling their property before it is foreclosed. An agent can advise you on the market value of your house, recommend measures to boost its value, and help find a buyer. They can also assist in negotiations with the lender to postpone the foreclosure process and give the homeowner more time to sell their property.

How To Keep Your House While Drowning – Final Words

Keeping your home while dealing with overwhelming debt requires proactive measures and a thorough understanding of the available options. Remember, your home is more than a roof over your head; but is a valuable asset worth fighting for.

By taking practical steps, seeking professional assistance, and showing commitment to resolving debt, you can regain stability and preserve the special feeling of homeownership.