Buying a home is a significant milestone that represents stability, growth, and the achievement of a lifelong dream. However, handling the complex house-buying process may be intimidating, especially for first-time buyers. This thorough guide will walk you through the entire home-buying process, from start to finish, so you have a complete understanding of what it’s really like to buy a home.

We will focus on the process of buying a home in Ontario, Canada. Although the rules and regulations might vary depending on where you live, the procedure is the same or similar in most parts of the world.

Table of Contents:

How to Buy a House: A Comprehensive Guide

You want to buy your forever home, but you don’t know where to begin? This comprehensive guide will help you learn how to buy a house in Canada. Buying a house is a significant milestone in many people’s lives, representing financial stability, personal growth, and a place to call home. However, purchasing a house can be complex and overwhelming, especially for first-time buyers.

| Did you know? The Government of Canada provides house-buying programs and incentives to help people purchase a home. |

The real estate market is dynamic and ever-changing, driven by various factors such as market conditions, lending rules, and legal requirements. That’s why it’s important to be informed and up to date on the newest trends and practices.

Assess Your Finances

It’s critical to assess your financial status before starting the home-buying process. Begin by analyzing your credit score, calculating your budget, and figuring out how much of a down payment and monthly mortgage payments you can afford. This self-assessment will assist you in establishing a reasonable pricing range and identifying any necessary financial modifications or preparations.

Research and Select the Right Location

When deciding on a location for your new home, consider the elements that are most important to you. Investigate factors such as closeness to your business, school quality, safety, facilities, and future development plans. Evaluating these factors will allow you to narrow down your options and focus on locations that align with your lifestyle and long-term plans.

Engage a Real Estate Agent

Home buying real estate agent is a valuable resource throughout the home-buying process. Search for an experienced agent who knows your needs, is educated about the local market, and can walk you through the process. They can help you discover suitable houses, negotiate offers, and manage all necessary paperwork, ensuring the sale goes smoothly.

Define Your Home Requirements

Make a list of your must-haves and deal-breakers for the features, size, layout, and condition of the home you want. Being willing to compromise is essential since finding the right property within your budget might be difficult. Communicate your needs clearly to your real estate agent, who can assist you in finding houses that meet your criteria.

Start the House-Hunting Process

After you’ve defined your needs, it’s time to look at available properties. View a range of homes by attending open houses, scheduling private showings, and using online listing platforms. Take notes, ask questions, and compare different homes to acquire a comprehensive understanding of the market and make informed decisions.

Perform Due Diligence

Do your due diligence when you find a home that meets your criteria and sparks your interest. Hire the assistance of a professional house inspector to evaluate the property’s condition, identify any flaws, and estimate repair costs.

In addition, look into the area, zoning restrictions, property taxes, and any present or past legal issues with the residence.

Make an Offer and Negotiate

Once you decide on a specific house, work with your real estate agent to create an appealing offer. To establish an appropriate price, examine the market, similar sales, and the seller’s goals. Negotiate terms and conditions, such as contingencies, closing dates, and potential repairs, with the seller to reach a mutually beneficial agreement.

Secure Financing

If your offer gets accepted, you’ll need to secure financing for your home. Compare mortgage choices from multiple lenders, considering account interest rates, loan terms, and closing expenses. Get pre-approved for a mortgage to show sellers your financial credibility and speed up the closing process.

Close the Deal

The closing process involves finishing paperwork, settling the mortgage, and transferring ownership. Work with your real estate agent, attorney, and lender to ensure that all necessary documents are in order. Conduct a final walkthrough of the property before signing the closing paperwork and getting the keys to your new home.

Exploring Different Ways to Buy a House

Purchasing a home is a huge financial decision, and there are several methods available for achieving this goal. While the traditional path for getting a mortgage and purchasing a home outright is the most common, new options have appeared in recent years. We will look at several ways to buy a property, providing a broader perspective for those who are considering becoming homeowners.

Buying a House at Auction

Buying a house at auction can be an experience as well as a method to get a good deal or buy a property fast. There are two sorts of auctions: the faster traditional method and the more flexible modern approach.

A traditional auction has a defined auction day and hour. The auctioneer will ask interested buyers to bid in rapid succession. In a modern house auction, you can place bids online until a specific date and time. In both cases, the seller will decide on an initial price. This is the lowest price they will take for a sale. The property goes to the highest bidder, who surpasses the reserve price.

If you are the highest bidder, you must pay a deposit or reservation fee on the auction day. Before bidding on a property at an auction, do your research.

How to Buy a Foreclosed Home in Canada

Foreclosed homes are often sold by lenders when the previous buyer fails to pay their mortgage. Foreclosures are rare and usually happen when a homeowner cannot afford their mortgage and fails to sell the house before the lender takes it. Foreclosed homes are often auctioned off.

| Did you know? Foreclosure houses can be sold for less than their market worth. |

In Canada, depending on the province, lenders will most likely use a Power of Sale or a Judicial Sale to recover any unpaid debts. The main difference is that the Judicial Sale process requires going through the court system, but the Power of Sale system enables the lender to sell the house without going through the court system.

It’s important to hire a real estate agent before buying a foreclosed home. They can reduce the risks related to buying a house of that type.

Financing Your Home Purchase

Depending on the buyer’s situation and preferences, financing for a home in Canada can be done through several methods. The most typical approach is a conventional mortgage that requires a credit score, a debt-to-income ratio, and a down payment.

Canadian homebuyers can also take advantage of government initiatives. These can help you buy your dream home. The programs and incentives include the First-Time Home Buyer Incentive, Home Buyers’ Plan (HBP), and GST/HST new home rebate.

Understanding Mortgages: A Key Step in How to Buy a House

Mortgages are an important part of the home-buying process. A mortgage is a loan issued by a lender that allows people to buy a home. The property is used as collateral for the loan, and the borrower agrees to repay the loan plus interest over a certain period of time.

When selecting a mortgage, elements such as interest rates, loan term, down payment, mortgage options, pre-approval, and additional costs should be taken into consideration. Compare interest rates from several lenders to discover the best deal.

Choose a loan term that corresponds to your financial goals and affordability. Evaluate your ability to make a down payment and research alternative mortgage possibilities. Consider being pre-approved for a mortgage before going house searching, and keep in mind the additional costs involved with owning a home.

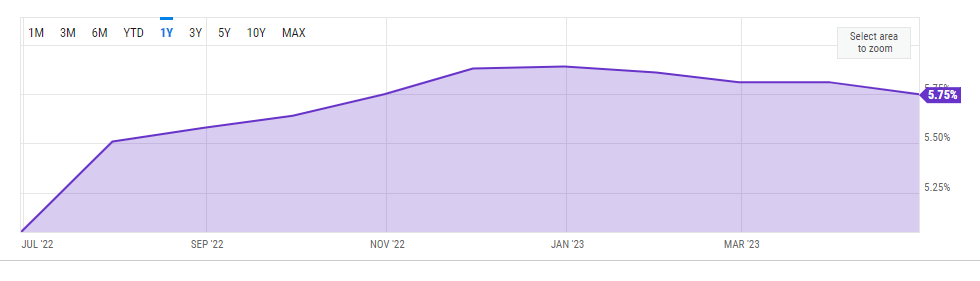

The 5-year conventional mortgage lending rate in Canada is now 5.75%, down from 5.81% last month and 4.1% last year.

How to Apply for a Mortgage in Canada

Applying for a mortgage in Canada is an important step for many people who want to buy a home. To apply for a mortgage in Canada, you must first evaluate your financial situation and ensure you are prepared to purchase a property. This involves reviewing your credit record and sticking to your budget. Before approving a mortgage, a potential lender will check your credit record.

If you don’t have a decent credit score, your mortgage lender may refuse to accept your loan or may approve it for a smaller amount or at a higher interest rate. To qualify for a mortgage, you must demonstrate to your lender that you can afford the requested amount. Mortgage lenders and brokers use your financial information to assess your monthly housing costs and total debt load.

They look at your income, spending, the amount you’re borrowing, your debts, and your credit report and score. Also, mortgage lenders typically need future homeowners to get house insurance to protect their interest in your home.

| Did you know? This tool helps you evaluate whether or not you can qualify for a home mortgage based on income and spending. |

It would help if you also considered getting pre-approved for a mortgage before searching for a house. Pre-approval offers an estimate of the loan amount you qualify for, allowing you to create a more realistic budget and gain an advantage in negotiations. Depending on the lender, the pre-approval procedure may allow you to discover the maximum amount of a mortgage you can be approved for, estimate your mortgage payments, and lock in an interest rate for 60 to 130 days.

Pros and Cons of Paying Cash for a House

Paying cash for a property has its pros and cons. Some advantages include the opportunity to close more quickly, waiving the appraisal contingency, and eliminating mortgage contingencies. You could also get a price reduction since you can skip many obstacles buyers financing their house must jump through. Overall, paying cash makes your house-buying process easier.

However, there are several disadvantages to paying cash for a property. One disadvantage is a lack of liquidity. When you pay cash for a property, you put up a large portion of your money in one asset, leaving you with less cash for emergencies or other investments. Furthermore, even if you have the means to pay for a property, there can be advantages to taking out a mortgage. For example, you can invest the money you save by paying cash in a way that earns you more than you would have spent in mortgage interest.

The Role of Real Estate Agents in Home Buying

Real estate agents are essential in the home-buying process. They operate as intermediaries for buyers and sellers, smoothing the transaction and ensuring both sides are happy with the outcome.

Buyers could benefit from the skills and knowledge of a real estate agent when working with one. Agents can help clients locate houses that fit their needs and preferences and provide essential knowledge of the home-buying process. They can also assist with negotiations for buyers to get the best price possible on their new house.

Kim and Howard are professional real estate brokers in the Toronto GTA area who can guide you through the home-buying process. They have an in-depth knowledge of the local market and can offer valuable guidance to buyers searching for a home in the region.

Choosing the Right Real Estate Agent for Your Home Purchase

Several factors should be considered when selecting a real estate agent for your home purchase. Look for agents that specialize in the type of property you want and are knowledgeable about the area in which you want to live. They should be familiar with the surrounding area and any local regulations or market nuances. Look into the agent’s reputation and for positive reviews from previous clients.

In every real estate transaction, effective communication is critical. Choose a responsive agent that listens to your needs and communicates clearly. Consider your compatibility and rapport with the agent since you’ll work closely together throughout the process.

When purchasing a property, negotiation skills are also essential. Choose an agent who will represent your interests and negotiate the best terms and prices for you. Check that the agent is looking out for your best interests as a buyer, and find out how they manage conflicts of interest.

A well-connected realtor can connect you with a group of experts involved in the home-buying process. Having reliable recommendations for these professionals might help speed up the procedure. Understand the agent’s fee system and verify that any additional costs or fees are transparent.

How Real Estate Agents Can Simplify the Home Buying Process

Real estate brokers play an important role in simplifying the home-buying process. They can assist with property searches, market expertise, advice and counselling, negotiations, transaction management, post-purchase support, and peace of mind.

Agents have access to resources that allow them to look for properties that fit their needs efficiently. They have extensive local real estate market knowledge and can offer important information and advise you throughout the transaction. Agents are trained negotiators who can represent your interests and negotiate the best possible deal for you.

They have a large network of specialists involved in the real estate buying process and can recommend mortgage brokers, home inspectors, lawyers, and other experts. Agents oversee transactions and collaborate with other parties to guarantee a seamless and organized process. Even after the sale is completed, agents can assist and advise. Having a real estate professional on your side will give you peace of mind throughout home-buying.

FAQ

What is the role of a home inspector during the house buying process?

A home inspector thoroughly inspects the property to assess its overall condition.

What should I know about homeowner’s insurance when buying a house?

Homeowners insurance protects you financially if your property or belongings are damaged. The policy typically covers interior and exterior damage, loss or damage of personal belongings, and injury suffered while on the property. Homeowner’s insurance costs vary on your location, coverage, provider, and discounts.

How does the negotiation process work when buying a house?

When buying a house, the buyer and seller talk back and forth until they reach a deal that works for both of them. The buyer makes the first offer, which the seller can accept, reject, or counteroffer. Negotiations can be about many different things until both sides reach an agreement.

What are the common mistakes to avoid when buying a house for the first time?

First-time home buyers should avoid frequent mistakes such as not understanding their budget, missing out on mortgage pre-approval, not researching the neighbourhood, and failing to schedule home inspections. It is essential to consider additional expenses and not make an emotional decision. Seeking professional advice may help you navigate the buying process and make informed choices.

Is buying an apartment or a condo different than buying a house?

There are differences between buying an apartment, condo and a house. The main difference is in the ownership. Apartments are held by landlords and rented to tenants, while buyers own condos.

Another difference is that condos usually have a homeowners association (HOA) to set rules and charge fees for property management and shared facilities. Houses provide more property control and freedom.

How to Buy a House – Final Thoughts

Buying a home is a challenging and exciting process, but with the right knowledge and support, it can be easy and rewarding. By following the steps provided in this text and working with the professional guidance of a real estate agent, you can successfully navigate the house-buying process, make educated decisions, and finally achieve your goal of owning your dream home.