Canada’s housing market experienced significant developments, with notable trends in national and regional home prices. Benchmark home prices have reached record highs in several provinces, while the national average shows more varied results. Despite ongoing pandemic challenges, a robust spring market has emerged, driven by renewed confidence among buyers and sellers.

National Benchmark Home Price Increase

In April 2024, the national benchmark home price, reflecting the cost of an average home, reached $735,900. This marks a 0.8% increase from the previous month, indicating a slight upward trend in home prices. However, despite this monthly rise, the price is still down 0.9% compared to the same period last year. Various factors, such as changing interest rates, economic conditions, and regional market dynamics, contribute to this complex housing market scenario. The slight increase in April could be seen as a sign of market stabilization or a temporary fluctuation within a broader downward trend.

Record-Breaking Average Home Prices

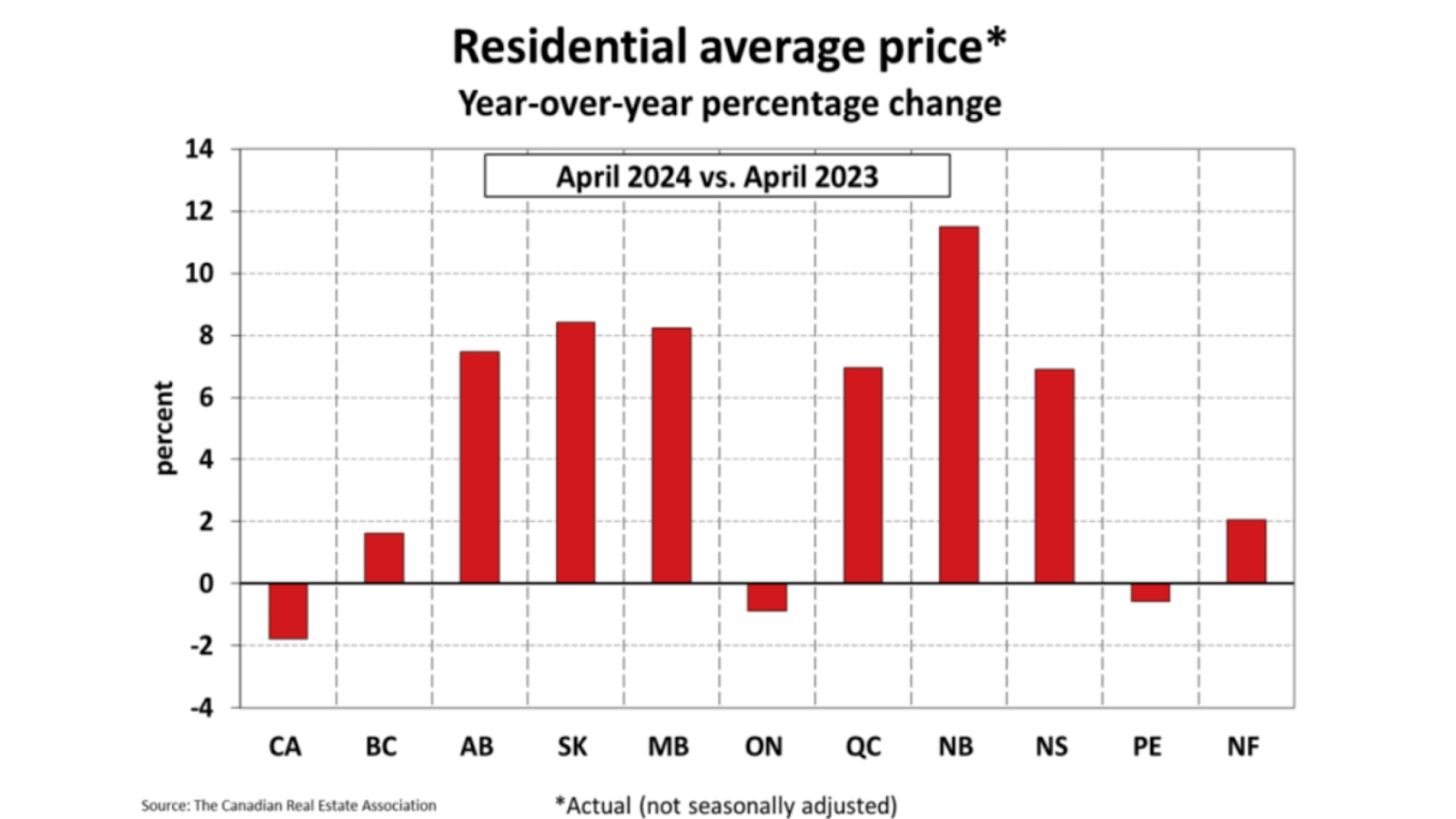

Benchmark home prices in Alberta, Saskatchewan, and New Brunswick soared to record-breaking all-time highs, highlighting a robust performance in these provincial markets. Concurrently, the average Canadian home price stood at $703,446, reflecting a 0.7% increase from the previous month. Despite this monthly uptick, the average price exhibited a 1.8% decrease compared to last year’s period. This trend underscores the variability within the Canadian housing market, where certain regions experience significant growth while the national average shows a more tempered performance.

Strong Spring Housing Market

Canada’s housing market is experiencing a robust spring, with several provinces breaking all-time price records. Despite the ongoing effects of the pandemic, home sales are picking up across the country, indicating a resilient market. Alberta, Saskatchewan, and New Brunswick, in particular, have seen benchmark home prices reach unprecedented highs in April 2024. Inventory levels are closely monitored as the balance between supply and demand shapes market dynamics. This resurgence in the housing market reflects a renewed confidence among buyers and sellers alike.

Regional Price Trends

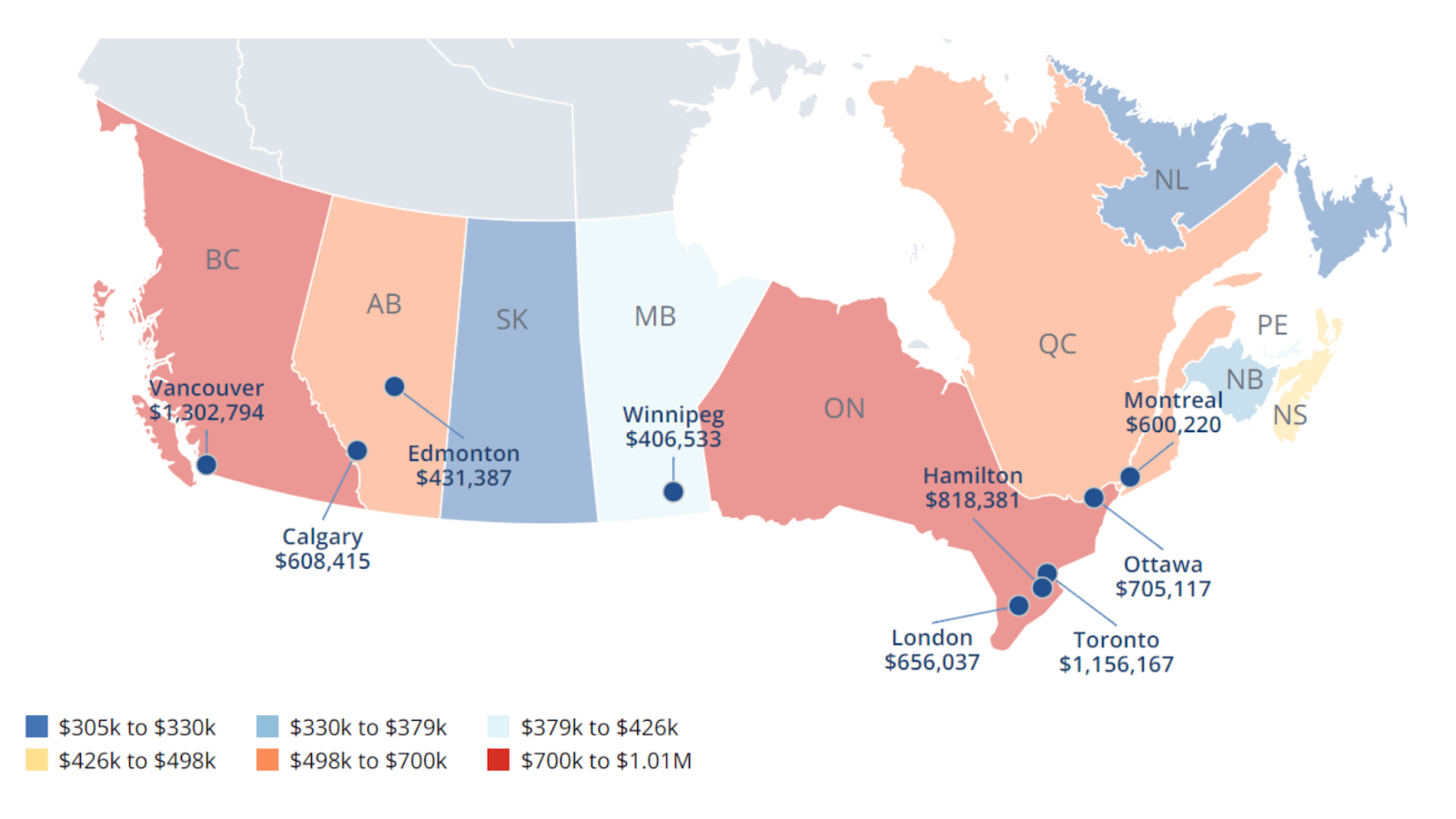

The average home prices by province in Canada showed significant variability, reflecting diverse regional market conditions. Here are the average home prices:

British Columbia: $1,006,248

Ontario: $900,161

Alberta: $499,505

Quebec: $498,124

Nova Scotia: $468,543

Manitoba: $382,658

Prince Edward Island: $379,366

New Brunswick: $334,561

Saskatchewan: $324,474

Newfoundland and Labrador: $304,570

These figures reveal a spectrum of market trends across the country. British Columbia and Ontario maintain their positions with the highest average home prices, while provinces like Alberta, Saskatchewan, and New Brunswick have witnessed unprecedented benchmark prices. In contrast, some regions have undergone significant price changes, both increases and decreases, over the past year. This diversity in price trends underscores the complexity of Canada’s housing market, driven by varying local economic conditions, demand-supply dynamics, and broader national factors.

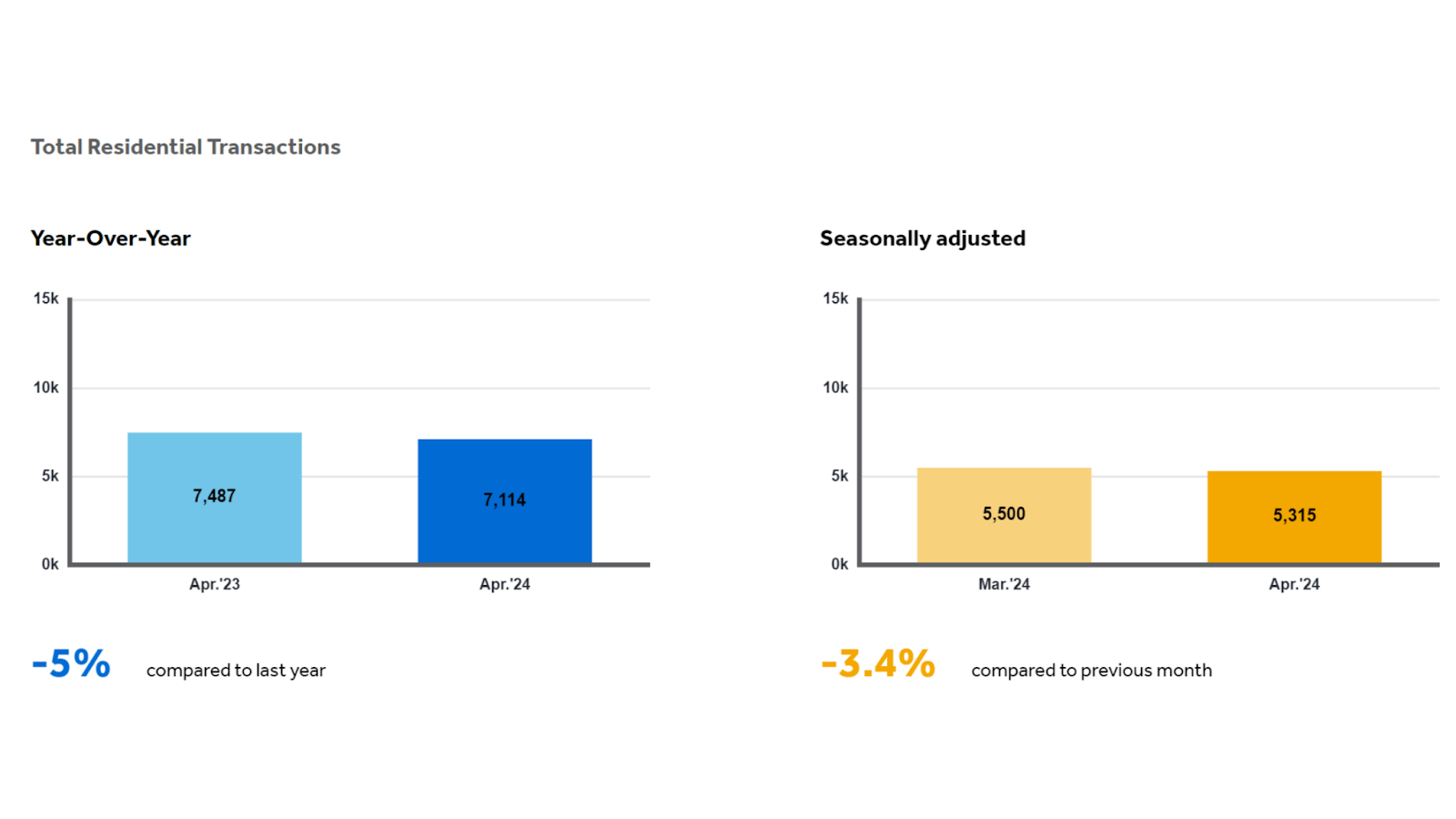

Balanced Market Conditions

In April, there was a drop in sales and an increase in new listings, which led to a slight decline in the national sales-to-new listings ratio to 53.4%. This is slightly below the long-term average of 55%. Typically, a sales-to-new listings ratio ranging from 45% to 65% indicates a balanced housing market. Balanced market suggests that the number of homes being sold is roughly in line with the number of new listings, preventing significant imbalances between supply and demand. In this environment, while some regions are witnessing price increases, others are adjusting to changing market conditions. For instance, provinces like Alberta, Saskatchewan, and New Brunswick have seen record-high benchmark home prices in April 2024. Conversely, other areas are experiencing price adjustments, reflecting localized economic influences and shifts in buyer behavior. Overall, the balanced SNLR indicates stability in the national housing market despite regional variations.

Conclusion

The Canadian real estate market is dynamic and diverse as always, with benchmark home prices reaching record highs in provinces like Alberta, Saskatchewan, and New Brunswick and a balanced sales-to-new-listings ratio indicating market stability. While the national benchmark home price has seen a slight monthly increase, it still reflects a year-over-year decline, highlighting the nuanced shifts within the market. The data underscores the complexity of the Canadian housing market, shaped by local economic conditions, supply and demand dynamics, and broader national trends. As we move forward, closely monitoring these factors will be crucial for understanding and navigating the future of the housing market in Canada.