Inflation plays a significant role in various aspects of our lives, impacting everything from daily expenses like groceries to leisure activities such as movie ticket prices. However, its vital to know the effects of inflation and the influence extends beyond these areas to the realm of Canadian real estate investments.

This article will delve into the dynamic and occasionally precarious nature of the housing market to explore how inflation shapes the landscape.

| What is inflation? Inflation is the rate at which the general level of prices for goods and services rises, consequently eroding purchasing power. It’s typically measured annually as a percentage, reflecting the decrease in the purchasing power of a nation’s currency. |

Table of Contents:

The Unique Nature of Real Estate

Real estate stands apart from other consumer products due to its distinct characteristics. While the price of most goods tends to rise with improving quality, real estate values don’t always follow this pattern. The culprit behind this anomaly is inflation.

In a free market system like Canada’s, the interplay between supply and demand reigns supreme. When there’s an excess supply of houses, prices generally decrease. Conversely, when the demand for housing surpasses the available supply, prices soar. This delicate dance between buyers and sellers can leave one’s head spinning faster than a roller coaster ride.

Imagine purchasing a house at a certain price one year, only to sell it for a significantly higher price just 365 days later without making any changes. It sounds like a dream come true, doesn’t it? Well, for investors who possess the acumen to navigate the market with agility, liquidity, and impeccable timing, this dream can become a reality. However, there’s a catch: for someone to win, someone else often has to lose, frequently leaving individuals without homes in the process.

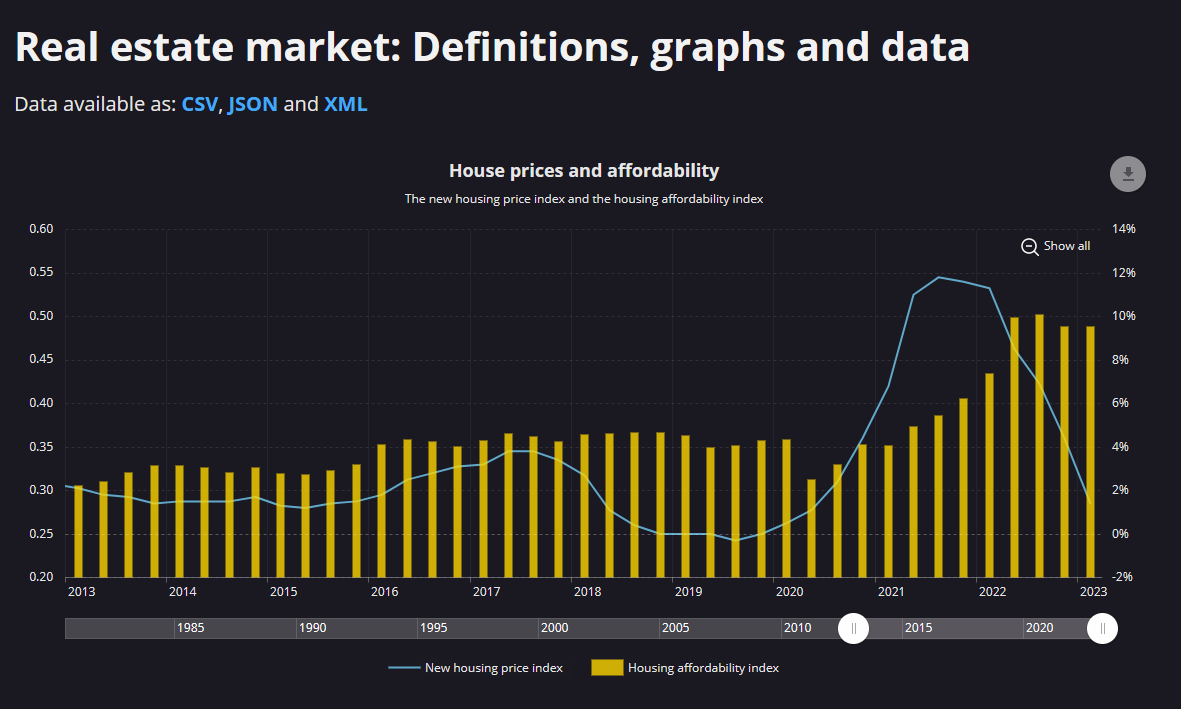

| Did you know? In 2023 or 2024, we anticipate an increase in prices and sales, with inflation reaching its target of 2% by the end of 2025. |

Critiquing the Free Market System

Former U.S. Secretary of Housing and Urban Development under Barack Obama, Julian Castro, encapsulated the situation well when he stated, “We know that in our free market economy, some will prosper more than others. What we don’t accept is that some folks won’t even get a chance.” This lies at the heart of criticism directed towards the free market or capitalist system, which engenders winners and losers, often leaving certain individuals without an equitable shot at success.

Demystifying Inflation

Now, let’s tackle the fundamental question: what exactly is inflation? According to the Merriam-Webster dictionary, inflation is “a sustained increase in the general price level of goods and services in an economy over a period of time.” To simplify, inflation occurs when the prices of goods and services keep rising due to an increase in circulating money.

American economist and humorist Sam Ewing offered a lighthearted take on inflation, saying, “Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair.” Even when discussing a dreary topic like inflation, Sam’s wit manages to bring a smile to our faces.

| Did you know? Inflation in Canada remains high but should come down quickly to around 3% in the middle of this year because of lower energy prices, improved supply chains and restrictive monetary policy. |

The Three Musketeers of Inflation

While economists may debate the different types of inflation, they largely agree on three primary classifications of inflation: cost-push inflation, built-in inflation, and demand-pull inflation. These terms describe scenarios where prices rise due to various factors, such as increased production costs, higher wages, or shifts in consumer demand.

Inflation: Friend or Foe for Investors?

When it comes to real estate investments, many individuals perceive inflation as a protective shield. They argue that inflation leads to higher rental prices and increased demand for rental properties. Thus, in theory, real estate investors should thrive during inflationary periods. However, as is often the case, reality isn’t that simple.

The impact of inflation on investors is contingent upon numerous factors, making it impossible to provide a one-size-fits-all answer. The outcome hinges on individual circumstances and specific market conditions.

The Buyer’s Predicament

If you’re an investor seeking to purchase properties during inflationary times, brace yourself for challenges. Soaring housing prices coupled with a scarcity of available properties can make it difficult to find favourable deals.

Moreover, if you rely on a lender to finance your investment, uncertainty surrounding future lending costs can disrupt your calculations. No one wants to witness their property lose value due to inflation, especially after investing a substantial sum to acquire it.

The Seller’s Silver Lining

Conversely, inflation can prove beneficial for investor-sellers. As prices rise, so does the value of their real estate portfolio. Savvy investors can capitalize on this situation, selling their properties for more than the purchase price and enjoying a significant boost in equity. Nevertheless, hold your excitement for a moment.

| Did you know? An August poll of 16 economists showed that after an expected 16% rise this year alone, average house prices nationally are expected to increase only 3.2% next year. |

While selling at a high price may seem enticing, remember that purchasing a new property in the same inflated market entails higher costs as well. Unless you have a well-thought-out plan for the next move, these increased expenses can quickly erode your profits. Striking the right balance necessitates careful consideration.

Navigating Uncertain Waters

The past year has been tumultuous for global financial markets, with real estate feeling the impact. Heightened volatility, supply chain disruptions, geopolitical tensions, rising inflation, and tighter monetary policies have created a stressful environment for Canadians.

However, it’s crucial to remember that we have faced similar challenges in the past.

| Did you know? In May, annual inflation, as measured by the consumer price index (CPI), decreased from 4.4% to 3.4%, its lowest level since June 2021. |

Though the specific causes may differ, we have weathered storms before. The key lies in learning from history and leveraging the lessons we have acquired to prepare for what lies ahead. Early predictions hinted at a recovery in Canadian inflation, but recent statements from the Bank of Canada advocate for a cautious approach.

The path forward remains uncertain. Thus, it’s time to hunker down, study economic history, and equip ourselves with the knowledge to navigate these turbulent waters.

| Did you know? Canadian home sales slipped 3% in July while average price fell to $662,000. |

FAQ

What is inflation?

Inflation is the rate at which the general prices for goods and services rise, eroding the purchasing power of a nation’s currency. It is typically measured annually as a percentage.

How does inflation affect real estate investments?

Inflation can positively and negatively affect real estate investments. It can lead to higher rental prices and increased demand for rental properties, benefiting real estate investors. However, inflation can also cause housing prices to soar, making it challenging for investors to find favourable deals. Additionally, inflation can increase the cost of financing a property, impacting the profitability of investments.

What are the three types of inflation?

Economists generally classify inflation into three primary types: cost-push, built-in, and demand-pull. These terms describe scenarios where prices rise due to increased production costs, higher wages, or shifts in consumer demand.

How does inflation impact buyers during inflationary times?

A: Buyers during inflationary times may face challenges in finding favourable deals due to soaring housing prices and a scarcity of available properties. Uncertainty surrounding future lending costs can also disrupt calculations, potentially reducing the value of properties over time.

How does inflation benefit investor-sellers?

Inflation can benefit investor-sellers as it increases the value of their real estate portfolio. Savvy investors can capitalize on this situation by selling properties for more than the purchase price, resulting in a significant boost in equity.

What should investors consider when navigating inflationary real estate markets?

Investors should carefully assess market conditions and consider the long-term implications when buying or selling real estate during inflationary periods. It is important to strike a balance and have a well-thought-out plan for the next move, as increased expenses in an inflated market can quickly erode profits.

How can investors navigate uncertain real estate markets affected by inflation?

To navigate uncertain real estate markets affected by inflation, investors should study economic history and equip themselves with knowledge. Learning from past experiences and staying informed about market trends can help in making informed decisions and preparing for potential challenges.

Effects of Inflation – Final Words

Inflation proves to be a complex force that can both aid and hinder real estate investors. While it may create opportunities for those adept at seizing them, it also presents challenges and uncertainties.

Whether buying or selling, it is crucial to carefully assess market conditions and consider the long-term implications. In the ever-evolving world of real estate, knowledge truly translates to power.