The dream of being a homeowner is an important milestone in one’s life, and for many Canadians, it can be a financially challenging endeavour. However, a hidden gem in the Canadian financial landscape can help you turn this dream into reality – the Registered Retirement Savings Plan (RRSP). Let’s explore together how you can leverage your RRSP to invest in pre construction homes, making the most of the HBP while navigating through its fine print.

Can You Use RRSP for Pre Construction Homes?

The question on many potential homebuyers’ minds is whether they can use their RRSP funds to invest in pre-construction homes. Pre construction properties can offer unique opportunities for investors, but how do they align with the HBP?

The good news is that the HBP doesn’t discriminate between pre-construction and existing homes. If your pre-construction property meets the criteria of a ‘qualifying home’ under the HBP, you can use your RRSP funds for the down payment. The key conditions for the property include having a written agreement to buy or build the home and the intention to occupy it as your principal residence within one year of purchasing or making it.

Pre-construction homes can provide excellent value and potential appreciation, making them an attractive option for homebuyers. With the HBP, you have the flexibility to consider pre-construction properties as part of your homebuying strategy.

| Did you know? New home construction rose by 28% in Toronto and by 47% in Vancouver compared to the previous year. |

What is a Home Buyers Plan (HBP)?

The Home Buyers’ Plan (HBP) is a government program offered by the Government of Canada that empowers individuals to withdraw funds from their RRSP to buy or build their first home. While it may seem like your RRSP is reserved solely for retirement, the HBP offers a unique opportunity to tap into these savings early, penalty-free, for a specific housing purpose.

Eligibility Criteria

Before diving into the details of investing in pre construction homes, let’s first explore the eligibility criteria for the HBP:

First-Time Home Buyer Status

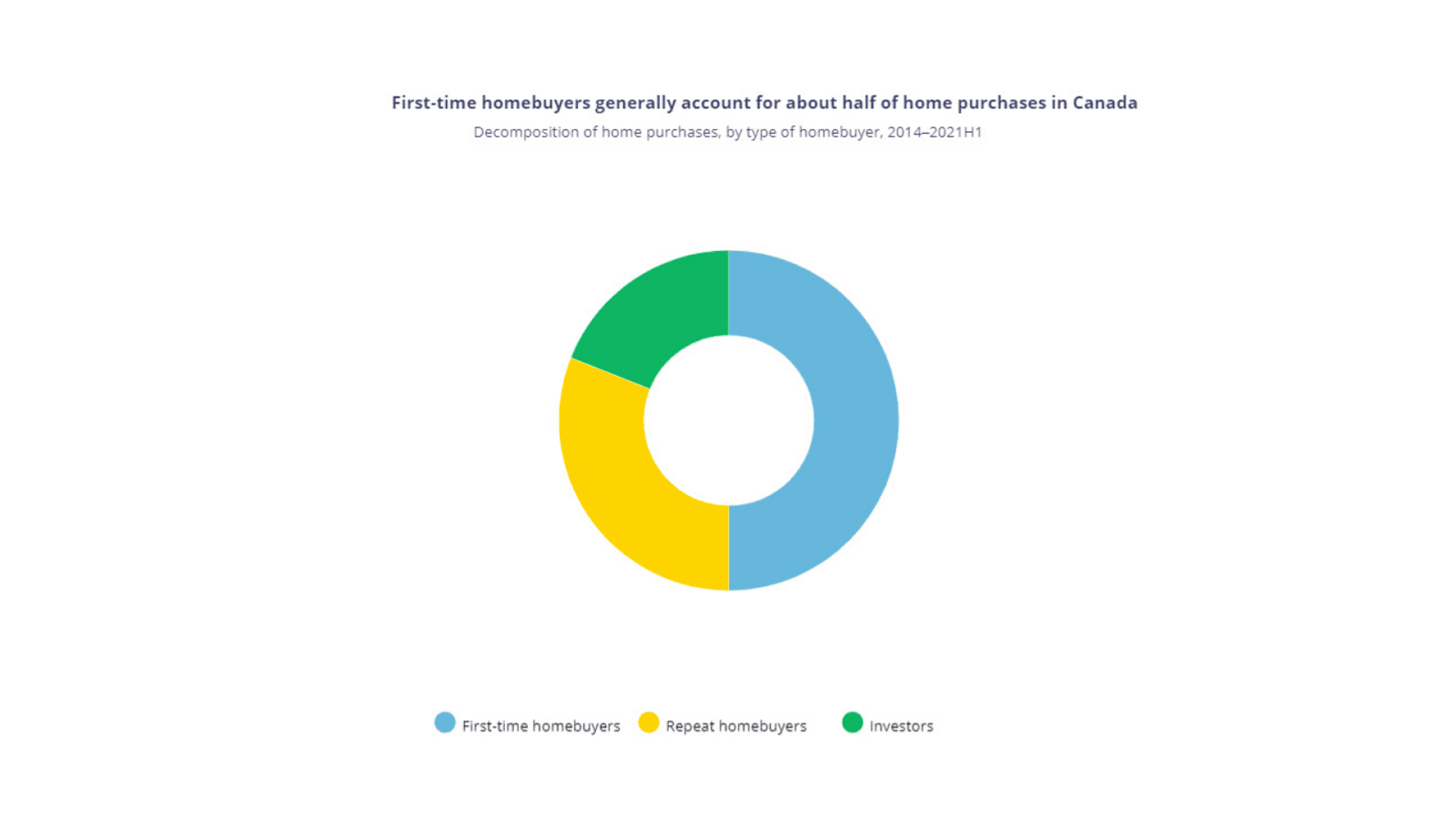

To qualify for the HBP, you must be considered a first-time home buyer. The good news is that even if you’ve previously owned a property, you may still meet the first-time home buyer criteria in the eyes of the government. According to the Government of Canada’s website, a first-time home buyer is defined as an individual who has not resided in a home owned by them, their current spouse, or common-law partner during the four-year period preceding the year in which they intend to withdraw funds.

This four-year timeframe commences on January 1st of the fourth year preceding the year in which you intend to withdraw funds and concludes 31 days before the actual withdrawal date. This definition offers flexibility, allowing many Canadians to reclaim their first-time home buyer status.

Qualifying Home Agreement

To participate in the HBP, you must have entered into a contract to buy or build a ‘qualifying home.’ It’s essential to have this contract in place before making the withdrawal. This requirement ensures that you have a concrete plan for homeownership and aren’t simply using your RRSP for general savings.

Residency

You must be a resident of Canada at the time of the withdrawal, which aligns with the program’s goal of facilitating homeownership within the country.

Intention to Occupy

An essential requirement of the Home Buyers’ Plan (HBP) is the obligation to live in the purchased or constructed home as your primary residence within a year from the date of acquisition or construction. This clause prevents participants from using the program for investment properties and ensures that the program genuinely supports homeownership.

Withdrawal Amount and Process

Through the Home Buyers’ Plan (HBP), you have the option to withdraw up to $35,000 from your RRSP. If you’re a couple, both partners can withdraw $35,000, allowing for a combined withdrawal of $70,000. It’s crucial to understand that this withdrawal must be executed within a single calendar year, and the funds in your RRSP need to have been held for a minimum of 90 days prior to the withdrawal.

In essence, you cannot deposit money into your RRSP to take advantage of the HBP shortly after that. The funds must genuinely represent your long-term savings.

How to Withdraw RRSP for Home Buyers Plan?

The process of making an RRSP withdrawal under the HBP is relatively straightforward. Typically, your RRSP issuer, which could be your bank, investment brokerage, or credit union, will guide you through the withdrawal process. If you have to manage the process on your own, you’ll be required to fill out Form T1036, which is officially named “Home Buyers’ Plan (HBP) Request to Withdraw Funds from an RRSP.”

This form entails answering several questions, providing your social insurance number, specifying the address of the ‘qualifying home,’ indicating the amount to be withdrawn, sharing the account number, and securing both your and the RRSP issuer’s signatures.

How to Pay Back RRSP for Home Buyers Plan?

While the HBP allows you to access your RRSP savings for your home purchase, it does come with a catch – you must repay the borrowed funds. This requirement is rooted in that contributing to your RRSP initially provided you with a tax benefit. If you fail to repay the funds, it’s only fair that you repay the original tax benefit as well.

The good news is you have a generous amount of time to repay these. You can take up to 15 years to repay the funds withdrawn under the HBP, and there’s no restriction on speeding up your repayment. You can repay the entire balance anytime you choose.

Many financial institutions, such as RBC, make the repayment process incredibly convenient by offering automatic RRSP contribution programs like RSP-Matic. This allows you to set up monthly, bi-weekly, or weekly contributions to ensure you never forget to repay.

It’s essential to note that HBP repayments do not impact your regular RRSP deduction limits, making it a relatively painless process to repay the borrowed funds while maintaining your retirement savings.

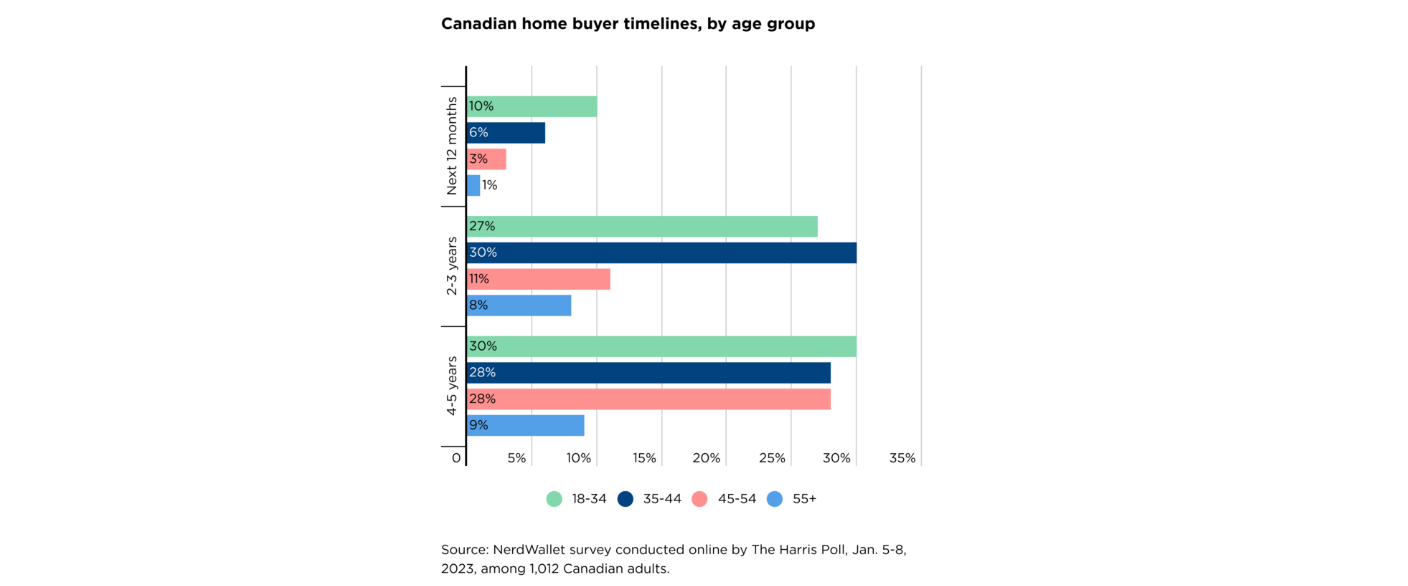

| Did you know? According to a study, 76% of Canadians intend to purchase a home in the following five years, and most of them plan to use a down payment, but almost a quarter of them admit they have not begun saving yet. |

When to Start Making HBP Repayments?

Your repayment schedule commences in the second year following the withdrawal of funds. For instance, if you initiated the withdrawal in July 2019, your repayment responsibilities would begin in the year 2020.

3 Benefits of Using the Home Buyers’ Plan

Now that we’ve delved into the intricacies of the HBP let’s explore the advantages of using this plan:

- Down Payment Assistance

The most significant advantage of the HBP is that it can offer you a down payment or help augment the down payment you’ve already saved. This can be a game-changer for many Canadians who may have struggled to accumulate a substantial down payment.

- Maintenance of Tax Benefits

The HBP allows you to maintain the original tax benefits you received when contributing to your RRSP. This preserves the tax advantages you enjoyed while building your retirement nest egg.

- Equity Building

Using RRSP funds as a down payment means moving cash into housing equity. After repayment, you’ll have both housing equity and your RRSP savings, contributing to your financial security.

The Four-Year Rule and Breakdown of Marital Partnerships

This rule establishes a first-time home buyer as someone who hadn’t lived in a property owned by them, their spouse, or common-law partner during the four years before their withdrawal year.

This rule opens the door for many individuals and couples who may have previously owned a home but are now ready to embark on a new homeownership journey. It allows people to reclaim their first-time home buyer status after a defined period, making the HBP accessible to a broader range of Canadians.

Additionally, the HBP recognizes the complexities of personal relationships. If your marriage or common-law partnership ends, you can still take advantage of the Home Buyers’ Plan (HBP) even if you don’t meet the criteria for first-time homebuyers. You are eligible for the HBP if you have been living apart from your spouse or partner for a minimum of 90 days due to a breakdown in your relationship.

It’s crucial to dispose of your previous principal residence no later than two years after the year in which the HBP withdrawal is made. This requirement can be waived if you buy out your spouse or common-law partner’s share of the residence. This flexibility ensures that individuals who have experienced significant life changes can still benefit from the HBP.

Planning for the Future

The HBP opens doors for Canadians looking to make homeownership more accessible and achievable. It offers a valuable tool for investing in pre-construction homes, making them a part of your homeownership strategy. By providing flexible repayment terms and recognizing unique housing needs, the HBP empowers individuals to take control of their housing future.

As you embark on your journey toward homeownership, it’s essential to consult with financial advisors, explore your options, and understand the intricacies of the HBP. With the proper knowledge and a solid plan, you can turn your dream of owning a home, whether pre-construction, accessible, or traditional, into a reality.

Conclusion

The Home Buyer’s Plan is valuable for Canadians aiming to purchase or build their first home. It’s a tool that provides accessibility and flexibility, allowing you to use your RRSP savings for various housing needs, including pre-construction properties and homes tailored to accessibility requirements.

By understanding the eligibility criteria, the process of withdrawal and repayment, and the unique provisions for disability-related housing, you can harness the full potential of the HBP. It’s a program that not only supports your journey to homeownership but also ensures fairness and flexibility in the repayment process.

As you explore your housing options, remember that the HBP can be a game-changer in making your dream of owning a home a reality. Whether considering pre-construction homes, looking to improve accessibility, or simply aiming for a traditional property, the HBP supports your homeownership journey.

FAQ

Can I use my RRSP funds to invest in pre-construction homes?

Yes, you can use your RRSP funds for pre-construction homes. The Home Buyers’ Plan (HBP) in Canada does not differentiate between pre-construction and existing homes as long as the property meets the HBP’s criteria for a ‘qualifying home.’ This includes having a written agreement to buy or build the home and intending to occupy it as your principal residence within a year of purchase.

What is a Home Buyers Plan (HBP)?

The HBP is a Canadian government program that allows individuals to withdraw funds from their RRSP to buy or build their first home, providing a unique opportunity to use retirement savings for housing.

Who is eligible for the HBP?

To qualify for the HBP, you must meet the first-time home buyer criteria, have a contract for a ‘qualifying home,’ be a Canadian resident, and commit to occupying the home as your principal residence within a year.

How much can I withdraw from my RRSP for the HBP?

You can withdraw up to $35,000 individually and a total of $70,000 for couples. The withdrawal must be made in one calendar year, and funds must be in the RRSP for 90 days or more.

Do I need to repay the funds I withdraw under the HBP?

Yes, you must repay the borrowed funds. You have up to 15 years to repay, and there’s no restriction on speeding up your repayment.

When do I start making HBP repayments?

Your repayment period begins the second year after you withdraw the funds.

What are the advantages of using the HBP?

The HBP offers down payment assistance, maintains tax benefits, and helps build equity while using RRSP funds for a home purchase.