In the captivating world of property investment, Ontario stands as an irresistible allure for those who dream of claiming their slice of land. With its sprawling landscapes, myriad opportunities, and untapped potential for development, Ontario emerges as a treasure trove for individuals and businesses alike. But what drives this fascination for land ownership within the province?

The ultimate question that echoes through the minds of many: Can you get a mortgage for land in Ontario?

Table of Contents:

Why do people consider buying land in Ontario?

The allure of land ownership in Ontario, Canada, is multifaceted, beckoning individuals for many compelling reasons. One of the primary draws lies in the diverse opportunities that Ontario’s vast expanse presents. The province’s land is a versatile canvas, welcoming agricultural endeavours, commercial ventures, and more, accommodating a broad spectrum of aspirations and ambitions.

Furthermore, the potential for appreciating land value is a compelling factor. Ontario’s evolving urban and rural landscapes contribute to this appeal. The dynamic nature of the province means that land investments often yield substantial returns over time, making it an attractive proposition for those seeking long-term financial growth.

Strategic locations also play a pivotal role in driving interest in land acquisition. Ontario’s land is strategically positioned, boasting proximity to bustling urban centers, efficient transportation hubs, and breathtaking natural attractions. This proximity not only facilitates accessibility and convenience but also adds intrinsic value to the land, making it an appealing prospect for potential buyers.

The main question: Can you get a mortgage for land in Ontario?

The primary query for aspiring landowners is whether they can obtain a mortgage for land purchase. This query has given rise to various lending options and strategies. Some notable points to consider include:

- Land Loan Options: Financial institutions offer specialized land loans tailored to the unique needs of buyers.

- Construction Mortgages: Those envisioning construction on their acquired land can explore construction mortgage options.

- Agricultural Loans: Agricultural projects can benefit from dedicated loan programs such as the Canada Agricultural Loans Act Program.

- Seller Financing: In certain cases, sellers may offer financing, simplifying the mortgage process.

- Down Payments: The down payment required for land mortgages can vary and is influenced by factors like credit history and intended land use.

- Interest Rates: Interest rates for land loans are influenced by market conditions, creditworthiness, and lender policies

Types of Land Loans in Canada

As we delve deeper into land ownership and financing, it’s essential to understand the diverse array of land loan options available in Canada. These specialized financing avenues cater to various purposes and projects with distinct features and benefits. Let’s unravel the intricacies of these land loans and shed light on their unique attributes.

Land Financing Sources in Canada

When it comes to financing your land purchase, Canada offers a plethora of options that extend beyond traditional residential mortgages. These options cater to various needs, including vacant land purchases, construction endeavours, agricultural projects, etc.

Differences between Land Loans and Traditional Residential Mortgages

Land loans have distinct characteristics that differentiate them from traditional residential mortgages. In these loans, there is a strong emphasis on the value of the land itself as collateral rather than focusing on its structures.

Additionally, due to the higher inherent risk, land loans tend to carry slightly elevated interest rates compared to the rates associated with traditional mortgages. Furthermore, land loans often come with shorter loan terms, reflecting the unique nature of investments involving land.

Vacant Land Loans and Raw Land Loans

For those looking to acquire undeveloped land, vacant and raw land loans are the go-to options. These loans are designed to facilitate land purchases without requiring immediate construction plans. Noteworthy aspects to take into account encompass the specifics of the land itself.

Vacant land loans are directed towards unimproved land, whereas raw land loans encompass more rudimentary properties. Furthermore, these loans acknowledge the inherent investment potential associated with land ownership, allowing buyers to secure land with future development prospects in mind.

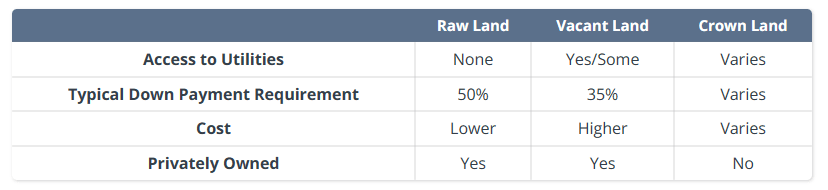

| Did you know? There are three types of land that you can purchase in Ontario: raw land, vacant land (zoned land), and Crown land. Raw land is land that has never been developed before and won’t have any utilities. Vacant land is land that is serviced or partially serviced. Crown land is public land owned by the provincial government. |

Construction Mortgages for Land and Home Building

These specialized loans are specifically designed to offer the necessary funds to construct residential structures. This approach brings forth a range of advantages for the borrower. Construction mortgages typically involve staged disbursements, aligning the release of funds with the various stages of construction progress.

Some lenders may offer an interest-only period during the construction phase. This provision alleviates the initial financial strain by permitting borrowers to make interest payments exclusively during this period.

Agricultural Loans for Farmland

For those venturing into agricultural endeavours, agricultural loans provide tailored financial support. These loans are designed to facilitate the purchase and development of farmland, catering to the unique needs of the agricultural sector.

Seller Financing Options

In some instances, sellers may offer buyers financing, bypassing traditional lenders. This option can simplify the mortgage process and provide more flexible terms.

Requirements and Challenges

While the prospect of owning a piece of land is enticing, it’s vital to be well-informed about the financial prerequisites and potential hurdles that come with it. This section delves into the high down payment requirements, the impact of high-interest rates, lender risks, and the significance of zoning and land-use considerations.

High Down Payment Requirements: A Barrier to Entry

When it comes to land loans, particularly for raw land purchases, potential buyers must be prepared for substantial down payments. These down payment requirements can range from 25% to as high as 50% of the land’s purchase price.

This is a barrier for many aspiring landowners, especially those seeking raw and undeveloped land. The challenge lies in accumulating the necessary funds to meet these stringent down payment demands.

High-Interest Rates for Raw Land Loans

Raw land loans are notorious for carrying higher interest rates than traditional mortgages. The increased risk associated with undeveloped land is a primary driver of these elevated rates. As a result, borrowers must carefully assess their financial capacity to manage these higher interest payments over the loan term.

| Did you know? Raw land can require a down payment of as high as 50%, with high interest rates for raw land loans from private lenders. |

The Risk Landscape for Lenders

Lenders face inherent risks when extending land loans, particularly for raw and undeveloped land. The absence of structures and improvements reduces the collateral value, making the loan riskier. Consequently, lenders mitigate this risk by imposing higher down payments and interest rates. This risk factor underscores strong financial stability’s importance in securing a land loan.

Zoning and Land-Use Consideration

Understanding zoning regulations and land-use policies is essential before land purchase and loan application. Zoning designations dictate how the land can be used, influencing its potential for development and investment.

Zoning regulations can impact the feasibility of the intended use of the land, from residential to agricultural to commercial purposes. Therefore, prospective landowners must navigate these regulations to ensure their plans align with zoning requirements.

Steps to Acquire a Land Mortgage in Ontario

From connecting with private mortgage lenders to acquiring necessary documentation, this section will guide you through the steps to make your land ownership dreams a reality.

| Did you know? When acquiring a vacant lot, lake lot, small acreage, or other bare land (up to 160 acres) intended only for your residential use – your down payment may be as little as 20%. |

Connecting with Private Mortgage Lenders or Mortgage Brokers

Both of these avenues present distinct advantages for potential borrowers. Private mortgage lenders are experts in providing non-traditional financing solutions, affording flexibility and tailored options that align with the precise demands of your land acquisition venture.

On the other hand, experienced mortgage brokers bring a wealth of market knowledge to the table, offering guidance to navigate through a spectrum of available loan choices, thereby ensuring well-informed decision-making on your part.

The Process of Applying for a Construction Mortgage

A construction mortgage is a viable solution for those aspiring to build their dream home on the acquired land. The application process involves several steps:

- Application Submission: Submit an application to your chosen lender or broker detailing your land purchase and construction plans.

- Project Appraisal: The lender assesses the feasibility and potential value of the proposed construction project.

- Approval and Terms: Upon approval, you’ll receive terms outlining disbursement stages, interest rates, and payment schedules.

- Disbursements: Funds are disbursed in stages as construction progresses, ensuring financial alignment with project milestones.

Necessary Documentation and Qualifications

To move forward with your land mortgage application, certain documentation and qualifications are required:

- Proof of Income: Demonstrating your ability to repay the loan is vital, often requiring recent pay stubs, tax returns, and financial statements.

- Creditworthiness: A solid credit history enhances your eligibility for favourable terms and interest rates.

- Land Details: Information about the land you intend to purchase and its intended use is crucial for lenders to assess risk.

Interest Payments During Construction

A noteworthy consideration during construction is the interest payments on the mortgage. In most cases, interest payments begin upon each disbursement of funds. During the construction phase, you’ll pay only the interest portion of the loan. This approach eases the initial financial burden, as you’re not yet repaying the principal amount borrowed.

Additional Costs and Considerations

In pursuing land mortgage acquisition in Ontario, it’s essential to grasp the additional costs and considerations that come into play beyond the loan itself. These financial aspects, often overlooked, can significantly impact your overall investment.

| Appraisal Fee | town – $300 rural – $400-$500 |

| Legal Fees | $1200-$1500 |

| Brokerage Fee | starts at $1500 up to 1% of the loan |

| Land Transfer Tax | 1% budget |

| HST/GST | 5-7% budget |

Appraisal Fees: Evaluating Property Value

Before proceeding with a land mortgage, lenders typically require an appraisal to determine the property’s value. Appraisal fees cover the cost of a professional assessment, ensuring the land’s worth aligns with the loan amount requested. While these fees may vary, they are an essential investment to ensure fair valuation.

Legal Fees: Navigating Legalities

Legal fees encompass the costs associated with legal professionals who guide you through the intricacies of property ownership and mortgage agreements. These experts ensure the transaction adheres to legal regulations, offering peace of mind and protection.

Brokerage Fees: Facilitating Transactions

In cases where you collaborate with a mortgage broker, brokerage fees may apply. These fees cover the broker’s services, an intermediary between you and lenders. Brokers leverage their expertise to secure competitive loan terms on your behalf, potentially saving you time and money in the long run.

Land Transfer Tax and HST/GST Considerations

The Land Transfer Tax is a provincial tax payable by the buyer upon property acquisition. This tax is calculated based on the property’s value and location. Additionally, the Harmonized Sales Tax (HST) or Goods and Services Tax (GST) may apply to the purchase price of newly constructed properties, impacting your financial commitment.

FAQ

Can you get a mortgage for raw land in Ontario?

Yes, you can get a mortgage for raw land in Ontario. Lenders typically consider it riskier than residential mortgages, so they may require a higher down payment and charge higher interest rates.

What is the typical down payment required for a land mortgage in Ontario?

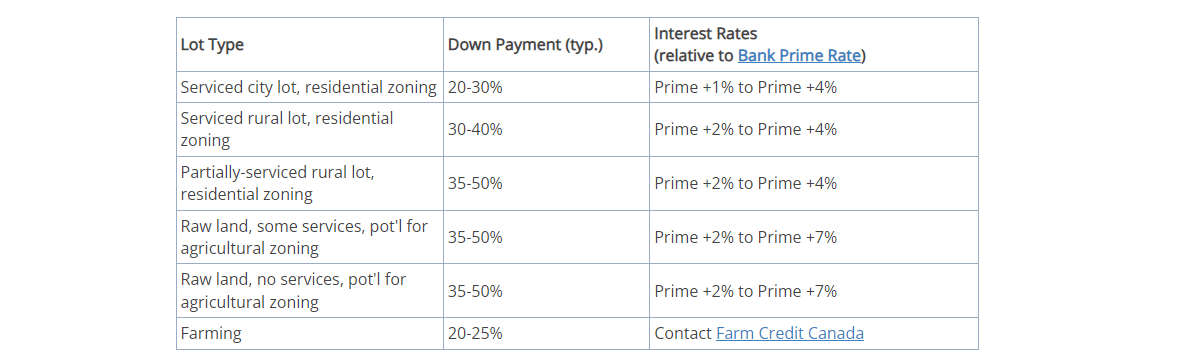

The down payment for a land mortgage in Ontario typically ranges from 20% to 50%. Urban, serviced land usually requires a lower down payment, while rural, unserviced land may require a higher down payment.

Are construction mortgages a good option for buying and building on land in Ontario?

Yes, construction mortgages are a viable option in Ontario. They allow you to finance the purchase of land and the cost of building a home, with funds released in stages as construction milestones are reached.

What are the interest rates like for land mortgages in Ontario?

Interest rates for land mortgages in Ontario are generally higher than for residential mortgages due to the increased risk for lenders. Rates vary among lenders and can be influenced by the borrower’s creditworthiness.

How does zoning affect my ability to get a land mortgage in Ontario?

Zoning dictates the permitted uses of land. Lenders are more likely to approve a mortgage for land zoned for residential use and may be hesitant to lend for land with restrictive or uncertain zoning classifications.

Can I buy vacant land with no money down in Ontario?

It is generally challenging to buy vacant land with no money down in Ontario. Lenders usually require a significant down payment due to the higher risk associated with land loans.

Are there government programs in Canada to help you buy land in Ontario?

Yes, the Canadian Agricultural Loans Act Program is a notable example that assists farmers in purchasing land. However, general land purchase programs are limited, and eligibility criteria apply.

Can You Get a Mortgage for Land in Ontario – Final Words

In our voyage through Ontario’s land mortgage terrain, we’ve unveiled the allure of land ownership, rich with growth potential and diverse opportunities. The question that initiated our journey—Can you secure a mortgage for land in Ontario?—now holds a comprehensive answer.

As we close this chapter, remember that knowledge empowers decisions. Your journey, whether spurred by growth potential, agricultural ambitions, or crafting a haven, is enriched by these insights. Seek professional guidance to tailor solutions to your narrative.

May your path to Ontario’s land ownership be rewarding, framed by your aspirations and guided by newfound knowledge.