Inheriting property can often be a bittersweet experience if coming in the wake of a loved one’s passing. While it can be a financial boon, it also comes with its own complexities, especially regarding taxes. In Ontario, the Land Transfer Tax (LTT) is a significant consideration for anyone involved in real estate transfer. But how does this tax apply to inherited property? This article delves into the intricacies of LTT in Ontario, focusing on its impact on inherited real estate.

Understanding the Basics of Land Transfer Tax (LTT)

The Land Transfer Tax is a provincial tax imposed on the exchange of real estate from one party to another. When a property is sold, purchased, or otherwise transferred, the government assesses a tax based on the property’s value. The primary purpose of the LTT is to contribute to public funds and municipal resources. It’s important to note that the tax rates and rules may vary by province, so we’ll focus on Ontario in this article.

Land Transfer Tax and Inherited Property: The General Rule

Typically, when property ownership is transferred, LTT applies. However, there is an exemption for inherited properties in Ontario. If you inherit a property due to the owner’s death, you generally are not required to pay LTT. This exemption also extends to property transferred to a spouse as a result of a separation agreement or a court order.

Factors Affecting the Application of LTT on Inherited Property

Despite the apparent simplicity of the exemption for inherited properties, there are circumstances in which LTT may still apply:

1. The Nature of the Will

If the deceased’s will doesn’t directly transfer the property to a beneficiary but instead instructs the executor to sell the property and distribute the proceeds, then the LTT may apply. This is because the property is technically transferred to a new owner, who would need to pay the tax.

2. Multiple Beneficiaries

In situations where a property is left to multiple beneficiaries, a transfer of ownership between beneficiaries (one heir buying out the others) could attract a land transfer tax. The tax would apply to the value of the transferred property share between the beneficiaries.

3. Beneficiary Outside of Ontario

For beneficiaries who live outside Ontario, the property will still be exempt from land transfer tax upon the initial inheritance. However, if they decide to sell the property, the purchaser must pay the LTT.

4. Estate Planning and the Role of Land Transfer Tax

Given the potential complexities of dealing with inherited property, having an efficient estate plan is crucial. Not only can it help minimize the overall tax liability, but it can also ensure a smooth transition of property ownership. Consider discussing your estate plan with a legal expert to better understand the implications of LTT and other potential taxes.

Who Pays Land Transfer Tax in Ontario?

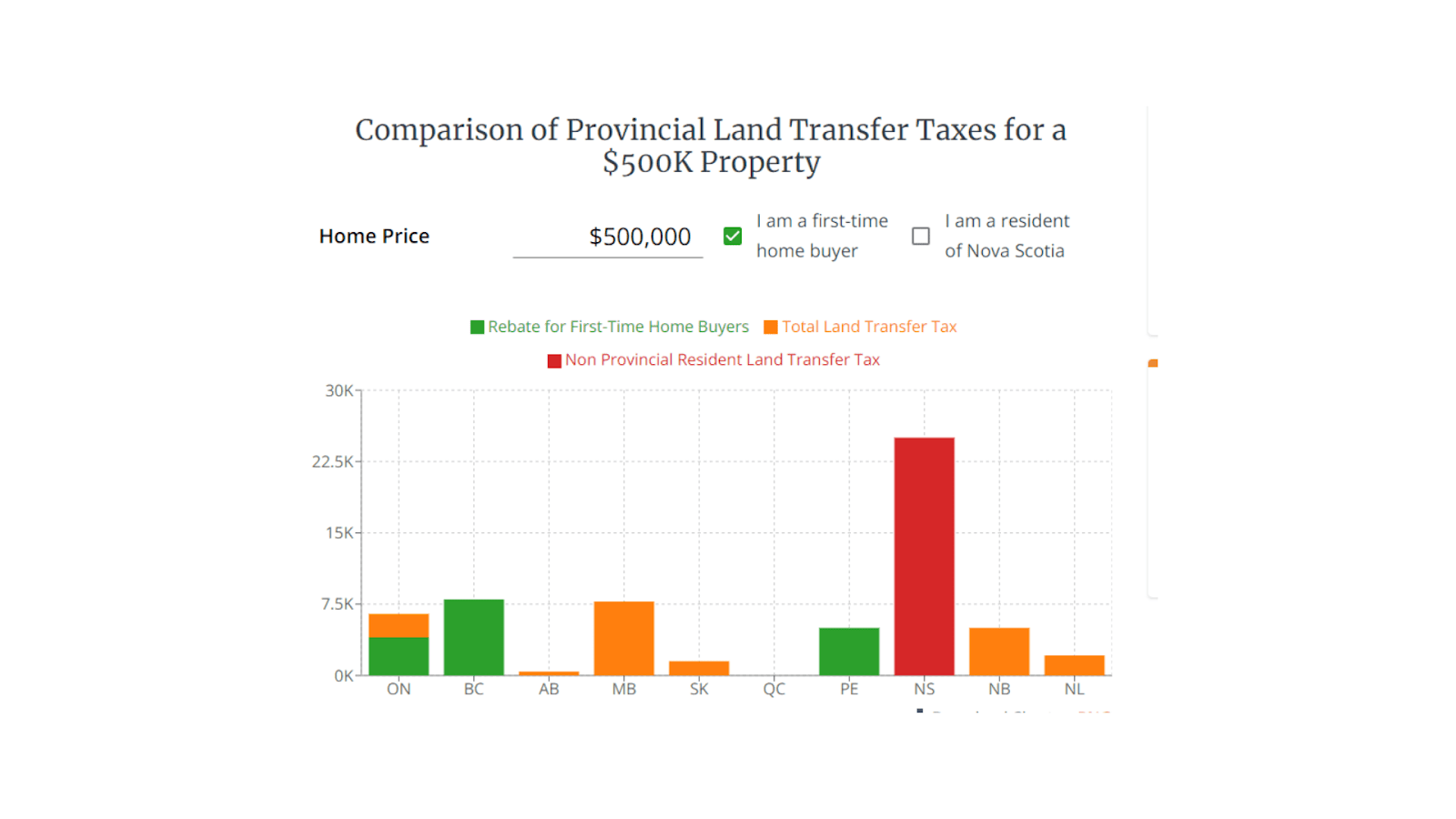

When you buy land or a stake in land, you have to pay a tax to the government when the deal is finalized. This is called Land Transfer Tax (LTT), and it applies in all Canadian provinces except Alberta and Saskatchewan.

There are some situations where you don’t have to pay LTT. For example, if you transfer land to your spouse, your family corporation, your relatives who farm the land, or a charity. Also, if you are buying your first home, you can get some money back from the LTT you paid..

| Did you know? Toronto is the only city in Canada that has a municipal LTT in addition to the provincial tax. This means homebuyers in Toronto pay a double LTT, making it one of the highest in the country. |

How is LTT Calculated in Ontario?

In Ontario, the Land Transfer Tax is calculated as a percentage of the amount paid for acquiring land. The calculation of tax accounts for any amount remaining on a mortgage or debt assumed on the land. The rates of land transfer tax in Ontario are as follows:

- 0.5% of the value for up to and including $55,000.

- 1.0% of the value exceeding $55,000 up to and including $250,000.

- 1.5% of the value exceeding $250,000 up to and including $400,000.

- 2.0% of the value exceeding $400,000.

- 5% of the value exceeding $2,000,000 when the land contains one or two single-family residences.

Exemptions to the Land Transfer Tax in Ontario

While LTT generally applies to property transactions, some exemptions and rebates can help reduce the tax burden in some instances. Some notable exemptions include:

- First-time Homebuyers: First-time homebuyers in Ontario may be eligible for a rebate of up to $4,000 on land transfer tax, depending on the purchase price of their home. To qualify, the home must be their principal residence, and they must be a Canadian citizen or permanent resident.

- Farm Property Rebate: If you purchase a farm property that meets specific criteria, you may be eligible for a Farm Property Rebate of up to $5,000. The property must be at least 5 acres in size and primarily used for agricultural purposes.

- Primary Residence Exemption: If you purchase a property to use as your primary residence, you may be exempt from paying LTT on the first $368,000 of the purchase price. This exemption is available regardless of whether you are a first-time homebuyer.

Land Transfer Tax in Estate Transfers

With

When someone who owns land by themselves dies and leaves a Will, the land goes to the person or people who are named in the Will. The land transfer tax is not payable when there is only one beneficiary. This type of situation is not taxable because the transfer occurs by operation of a legal instrument, otherwise known as the will. The land transfer tax statements should state clearly that only one beneficiary gets the land.

Without

If someone dies without a Will and owns the land, the Succession Law Reform Act decides who gets the land. Where there is only one person who inherits the land, they don’t have to pay land transfer tax because there is no value for consideration of the transferred property. The land transfer tax is payable if there is more than one beneficiary. Likely, this is because there has been a consideration for value.

Frequently Asked Questions (FAQ)

What is the Land Transfer Tax rate in Ontario?

The Land Transfer Tax rate in Ontario varies depending on the property’s value. It follows a tiered rate structure. Here’s a breakdown of the rates for residential properties:

- Up to $55,000: 0.5%

- $55,000 to $250,000: 1.0%

- $250,000 to $400,000: 1.5%

- $400,000 to $2,000,000: 2.0%

- Over $2,000,000: 2.5%

Are there exemptions for inherited property?

Yes, exemptions are available for inherited property in Ontario. One common exemption is for direct family transfers, such as inheriting property from parents, children, or grandparents. Additionally, if the property is used as the primary residence, there may be eligibility for an exemption.

How do I calculate the tax?

Calculating Land Transfer Tax involves multiplying the property’s value by the applicable LTT rate. The rate varies based on the property’s value, as mentioned earlier. You can use online calculators to estimate your tax liability.

What are the deadlines for payment?

The deadline for paying Land Transfer Tax in Ontario is typically within 30 days of the property transfer. Adhering to this timeline is essential to avoid penalties and interest charges.

Conclusion

Inheriting property in Ontario can be a complex process, and understanding the implications of the Land Transfer Tax is essential. The amount of tax you’ll have to pay will depend on various factors, including the property’s value and the nature of the transfer. With proper estate planning and legal advice, you can navigate this process efficiently and minimize the impact of the Land Transfer Tax on your inheritance.

It’s important to be aware of the rules and exemptions related to Land Transfer Tax, as they can significantly affect your financial obligations during the inheritance process. Additionally, first-time homebuyers in Ontario may be eligible for a rebate on the Land Transfer Tax, so it’s worth exploring the available options to reduce your tax liability.

Navigating the intricacies of Land Transfer Tax, especially when dealing with inherited property, can be daunting. While this article provides a general overview, each situation is unique and might have specific considerations that aren’t universally applicable. Therefore, it’s advisable to consult with a professional, such as a real estate lawyer, who can provide personalized guidance and help you make informed decisions throughout the inheritance process.

In summary, understanding the nuances of the Land Transfer Tax is crucial when it comes to inheriting property in Ontario. With the right information and professional support, you can ensure a smooth transition of property ownership while managing your financial responsibilities effectively.